TOP 3 Corporate Bond ETFs to buy alongside the FED | Review of LQD, VCIT and VCSH

Key Takeaways

The purpose of the below analysis is LQD Review. We have also compared it to Vanguard’s VCIT.

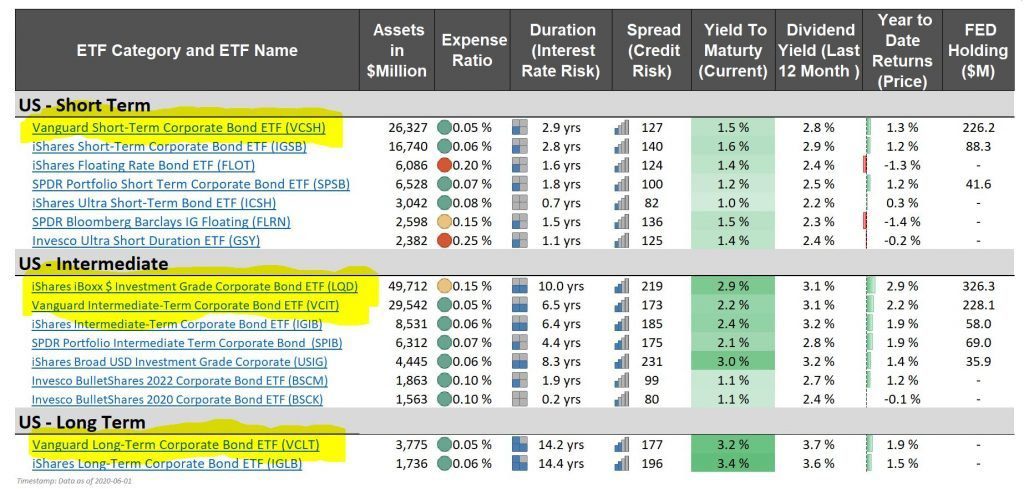

Intermediate Term Corporate Bond ETFs which fit the average investor requirements have attracted most of the FED purchases in June. In fact, 2 ETFs – LQD and VCIT represent over 45% of all Investment Grade Corporate Bond ETF FED Holdings.

Should you wish to choose a shorter or longer duration funds we have reviewed the two largest in their respective categories for comparison (VCSH and VSLT), although only the shorter VCSH is explicitly supported by the FED.

Here is what you need to know:

- Vanguard Short Term Corporate Bond Fund (VCSH) – Will appeal to a short term investor looking primarily for safety. Maximum weekly drawdown during Covid-19 of c.10% and explicit FED support (2nd largest holding). Given it’s short duration inflation risk is limited. The ETF currently yields 1.5%*

- Vanguard Intermediate Term Corporate Bond Fund (VCIT): A true intermediate term ETF, VCIT is for medium term investors looking for yield pick up. The Fund is being explicitly supported by the FED (3rd largest holding). With more inflation and credit risk compared to its short term Vanguard ETF it currently yields 2.2%*

- iShares Investment Grade Corporate Bond Fund (LQD): Borderline Long Term Category this ETF is for yield seeking investors that have a longer investment horizon. BlackRock’s LQD Fund is the most recognized Corporate Bond ETF and is the #1 FED Holding. Given it’s increased interest and credit risk vs. VCIT the yield is currently close to c. 3%*

- Vanguard Long Term Term Corporate Bond Fund (VCLT): This is the only reviewed fund currently not directly supported by the FED. Yield pickup is marginal over iShares LQD. While credit risk is similar to VCIT there is potential for more price volatility should rates increase. You should pick this fund is you have a long term horizon. You should have more risk tolerance and have already an inflation hedge to mitigate such risk. This ETF currently yields 3.2%*

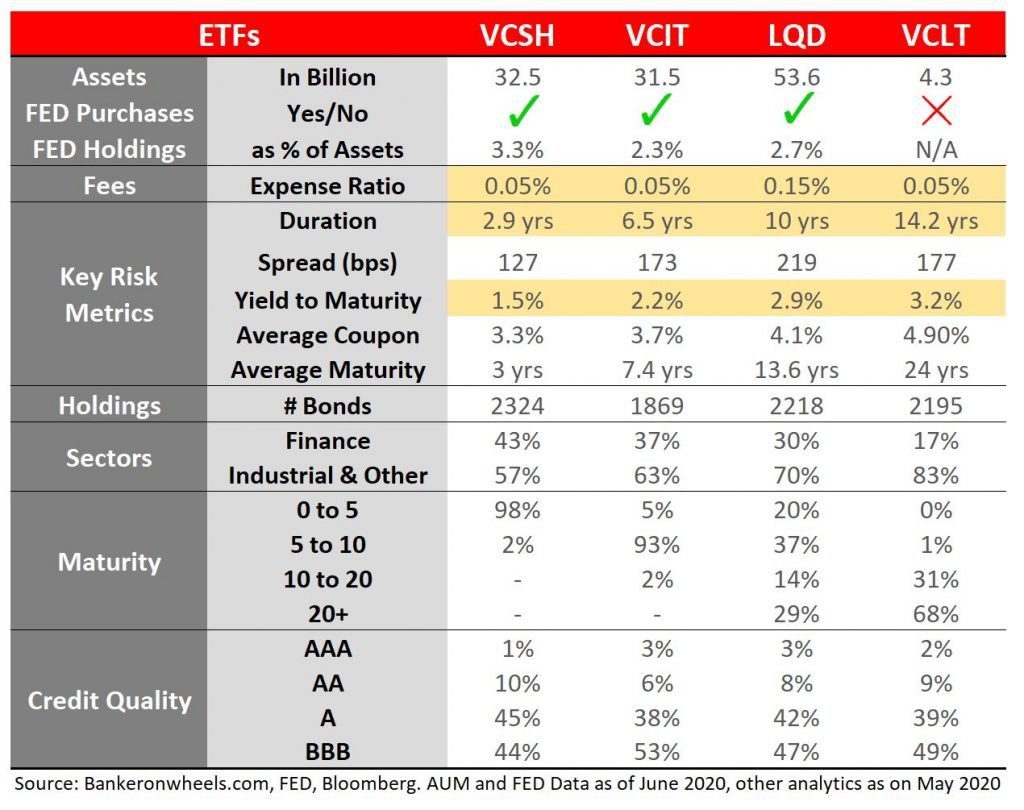

Comparison of key characteristics and Long Term Performance

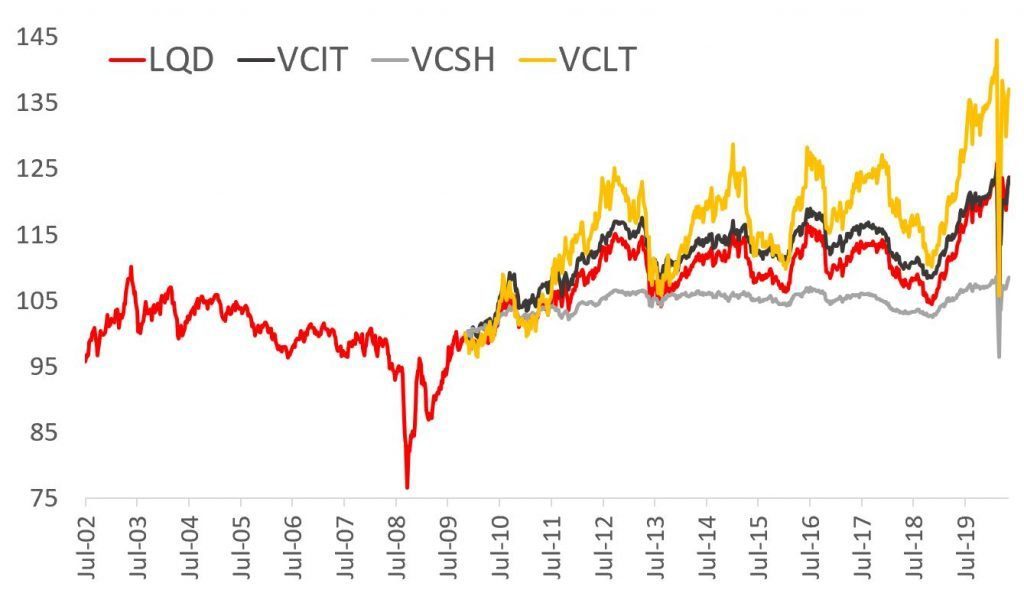

Long Term Price Performance - LQD, VCIT, VCSH & VCLT

Context

- With over $100 bn of newly issued Investment Grade bonds in April and May Issuers have benefited from the FED support and ensured they have enough short term cash to withstand Coronavirus Market

- However, balance sheets are weaker due to macro outlook and increased debt

- Downgrade risk is very significant with S&P downgrade to upgrade ratio of 43.2x – that’s 43 downgrades for one upgrade, the highest since the GFC (which was 8.4x)

- Solid companies should benefit from FED support and expand their long term market shares through internal or external growth

- The below review focuses on the three main funds supported by the FED but you can find most of the funds in the Bond ETF Guide

- Inflation needs to be taken into account when looking at Yields. Current breakeven (expected) inflation is 0.25% (2 yr), 0.7% (4 yr) and 1.2% (10 yr)

- Below are gross yields before any fees (need to accounted for before you invest)

Key Fund Characteristics and FED SMCCF ETF Holdings

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

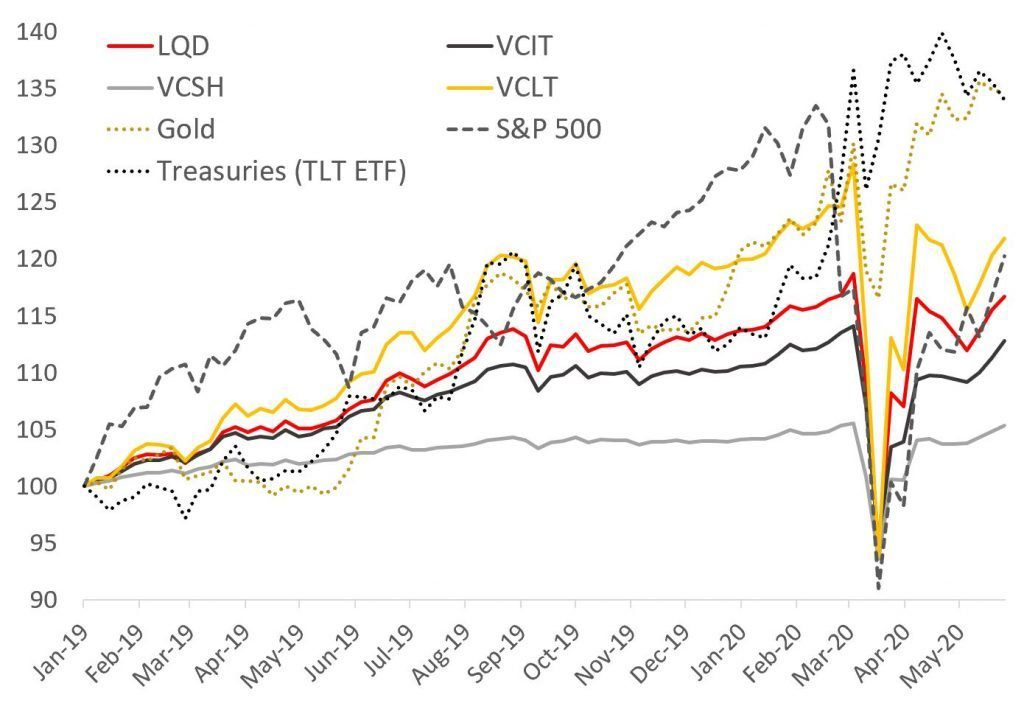

Recent Performance and how each ETF provided Protection during Coronavirus sell-off

Investment Grade Credit ETFs didn’t provide much protection during the March sell off. Looking from a portfolio protection perspective Long Term Treasury Bonds (iShares 20+ Year Treasury Bond ETF or TLT) were the only asset class with negative correlation. Gold has lost ground for technical reasons (although arguably Treasuries had also their share of technical issues) but quickly recovered. Bond ETFs have reacted based on their Risk Profile / Term with longest one (VCLT) very closely correlated with the S&P 500.

Recent Performance and Coronavirus Market Sell-Off

While this is the first real test for Vanguard Funds that were established post GFC, LQD has a longer track record that dates back to 2002. During the GFC the magnitude of the drawdown is similar but with very different circumstances (Industrials weigh 70% in the fund and were arguably potentially much more affected now than during the Financial Crisis) justifying a major FED intervention this time.

LQD Review during the Global Financial Crisis - Price Performance

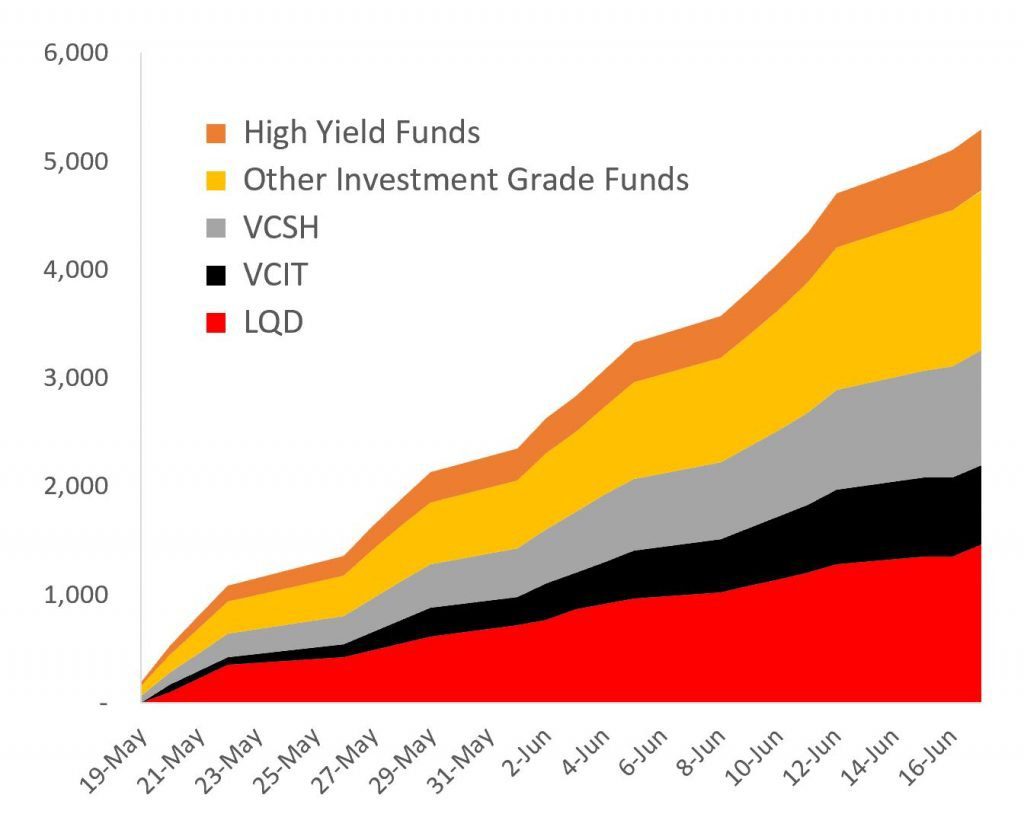

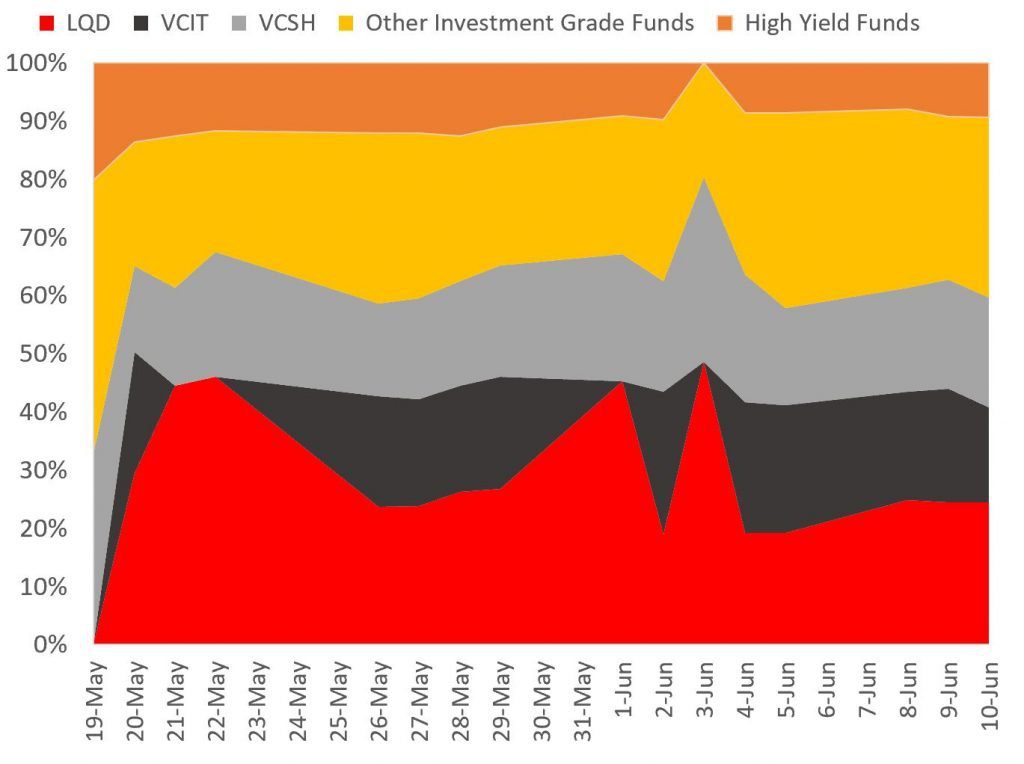

Both Intermediate Term funds have attracted the bulk of the FED purchases (c. 45% of all High Quality Corporate Bond ETFs). Adding the Short Term VCSH Fund and we cover c. 60% of all FED purchases which have been relatively similar over the disclosed time period (second chart below). This highlights the high concentration of Investment Grade Funds compared to High Yield where a number of smaller funds have made it onto the FED list.

Cumulative FED Purchases (SMCCF) - VCSH, VCIT and LQD

Relative Size of FED ETF Trades over time

Summary of Findings for TOP 3 Corporate ETFs

All of the reviewed funds have low tracking error and are well diversified

LQD Review (iShares iBoxx $ Investment Grade Corporate Bond ETF)

Pros:

- Great Brand: LQD is perhaps the most recognizable name in Corporate ETF space and it is the #1 on FED SMCCF Purchase List in absolute amount

- Longest Track Record: Established in July 2002, it has the longest track record of all the reviewed Funds

- Liquid and diversified: Very liquid and diversified across over 2,200 Bonds

- High Yield: With a longer term and marginally more aggressive profile the spread is higher at 219 bps which explains most of the difference in Yield (2.9% before and c. 1.7% after inflation) vs. Vanguard VCIT (2.2% before inflation and 1.2% after inflation).

- Strong Sponsor: BlackRock provides better transparency of holdings and analytics

- Most Expensive: It is the most expensive on the list (0.15%) which makes an impact on your overall return over the long term

- Inflation Impact Risk: With a duration of c. 10 years it is borderline a Long Term Bond Fund and more exposed to increase in interest rates should inflation pick up

- Credit Risk: Issuers are slightly more aggressive than the Vanguard Fund with a Spread of 219 bps partially due to longer maturities

VCIT Review (Vanguard Intermediate-Term Corporate Bond ETF)

Pros:

- Fees: Vanguard only charges 0.05% which is much lower than BlackRock

- Support from the FED: VCIT ETF is the #3 holding by the FED in absolute amount and also #3 as % of total assets

- Lower Inflation Risk: Given it’s duration of 6.5 years inflation risk is reduced compared to longer dated funds including BlackRock’s LQD

- Lower Price Volatility: Given tighter spreads and lower duration the risk of any shock is lower than LQD as witnessed during the Coronavirus Sell-off

- Lower returns: Lower volatility comes at the expense of Yield – as indicated above after inflation return is c. 0.5% lower for Vanguard’s ETF (Return of 2.2% before inflation and 1.2% after inflation)

- Marginally higher concentration: The shorter the Fund the higher the concentration in Financial Bonds which is the case for VCIT vs. LQD or even the longer-end VCLT

- Marginally higher downgrade risk: While spread is c. 50 bps lower vs. LQD it’s partially due to shorter maturity bonds. VCIT has the highest concentration is the BBB Rating Space which could be impacted by rating agency downgrades due to Coronavirus

VCSH Review (Vanguard Short-Term Corporate Bond ETF)

Pros:

- Fees: Vanguard only charges 0.05% which is much lower than BlackRock

- Support from the FED: VCST ETF is the #2 holding by the FED in absolute amount and #1 on relative basis

- Low Inflation Risk: Given it’s duration of just 2.9 years inflation risk is reduced compared to intermediate dated funds

- Low Price Volatility: The fund has seen a maximum weekly drawdown of c.10% which is much lower compared to other credit funds

- Decent Real Returns vs. VCIT: Given the low short term inflation the 1% real yield is still relatively good compared to VCIT which has a much longer investment horizon

Cons:

- Low returns: Given it’s safer profile the yield stands at 1.5% before inflation and c.1% after inflation

- High concentration in Financials: The shorter the Fund the higher the concentration in Financial Bonds which is also the case for VCSH (at 43%) vs other reviewed ETFs

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

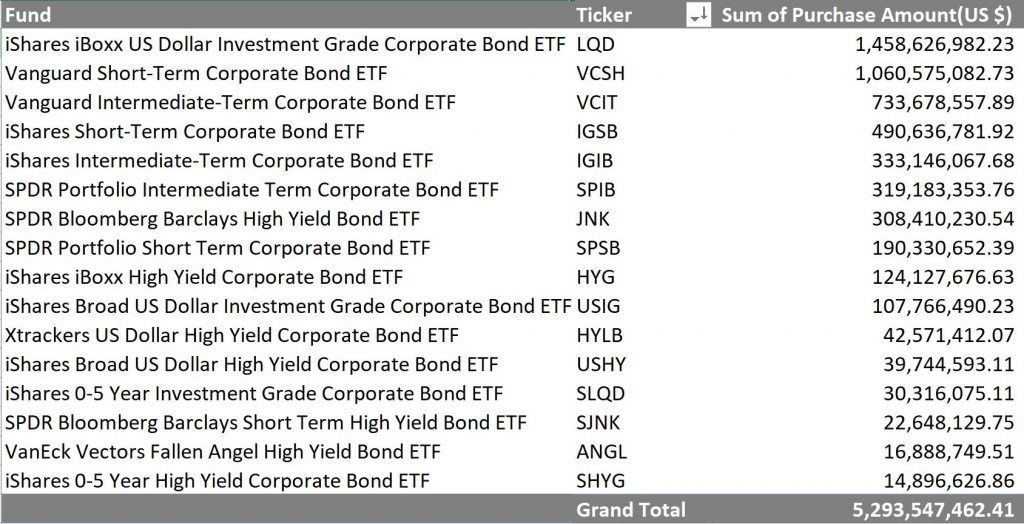

Appendix

Full list of ETFs bought by the FED

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.