Why Risk Aversion and Time Horizon matter most in Investing Success

Key takeaways

- While Risk Aversion is specific to your profile it is key to determine it to avoid devastating returns

- Investment Time Horizon may improve the odds of your returns given that over a long period of time Stocks tend to go up (outside of isolated cases like Japan)

- Unless you have a very long time horizon and very high risk tolerance diversification will help you achieve higher returns

Good things come to those who wait

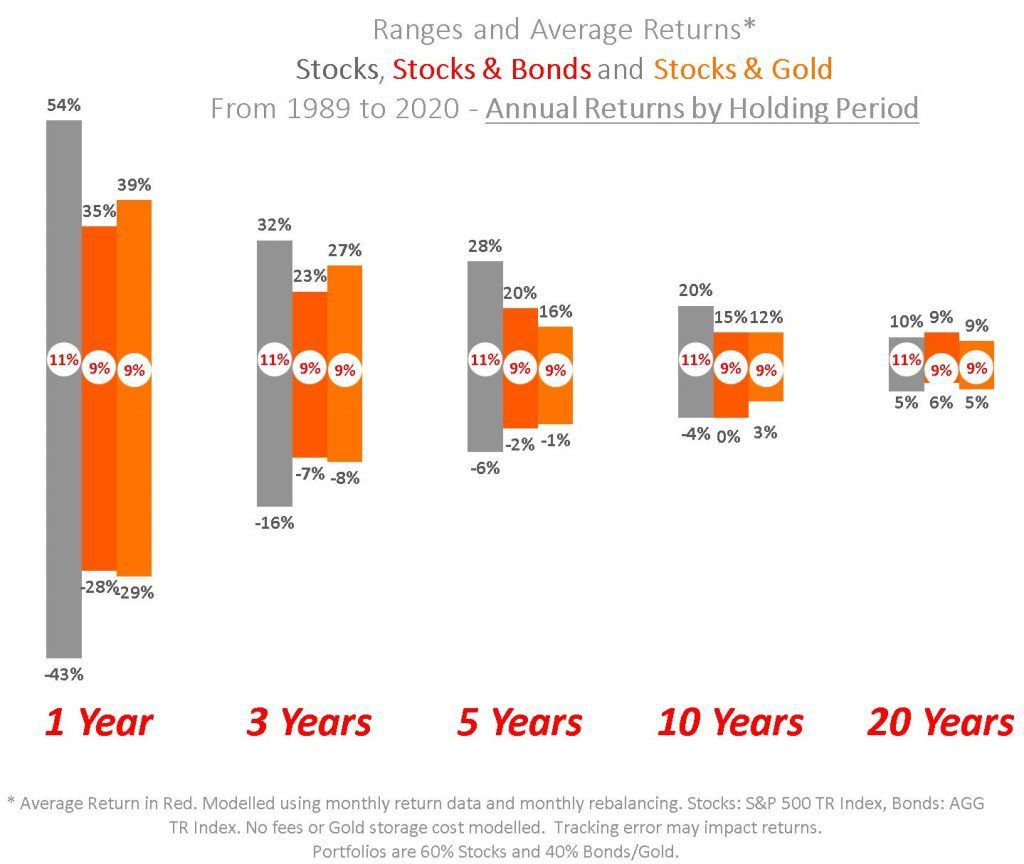

The below graph is quite powerful and shows how time is generally your greatest ally

- While one-year stock returns have varied widely since 1989 (+54% to -43%), a blend of stocks and bonds has not suffered a negative return if held over 5 years in the past 30 years (the same result if also valid before 1989)

- The ranges of possible negative outcomes are reduced the longer you hold the investment portfolio assuming that the Stock Market continues it’s historical upward trend over the Long Term

- The chart below shows that by holding you portfolio for a period of above 20 years you were historically making an annual return between 9% to 11% depending on the composition of your portfolio (note that given current low yield environment expectations should be lower)

How Time improves Odds of High Returns

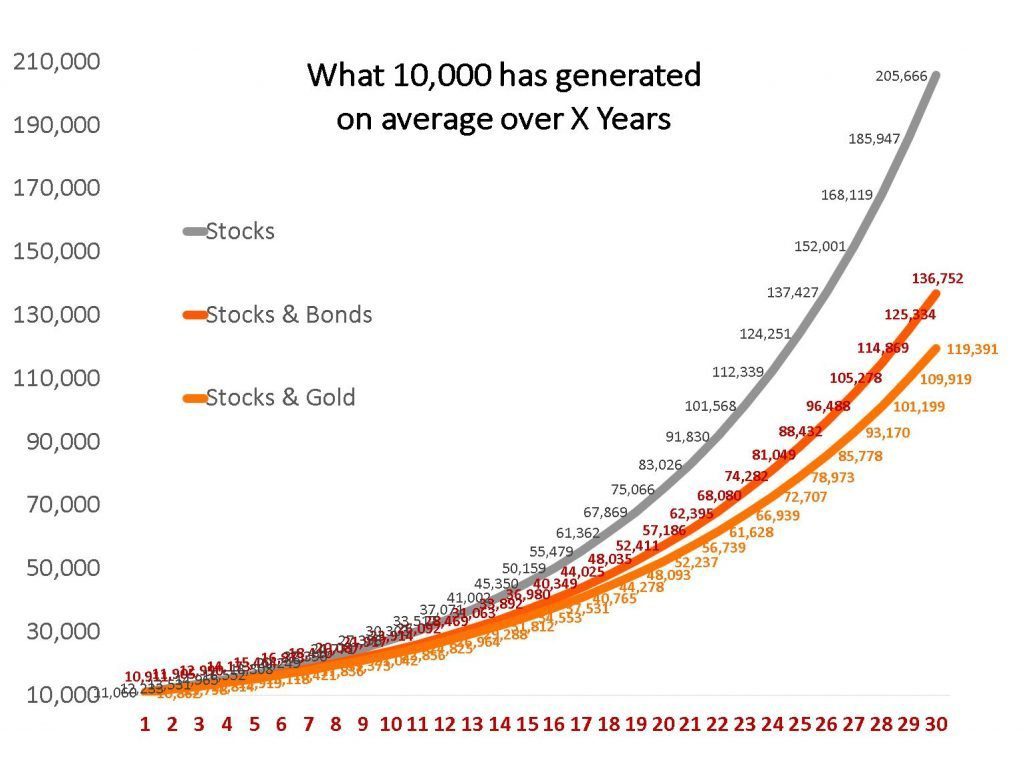

How to reach Financial Independence with Stocks - Time is your greatest Ally

- If you hold on tight for over 10 years even with the riskiest strategy (100% Stocks) your worst case is getting your money back but the upside is rewarding

- In theory, Financial Independence can be reached just by using Stocks alone provided you have a very high risk tolerance (which most investors don’t – hence I wouldn’t recommend it) and very long remaining time horizon

- $10,000 Investment would generate on average over $200,000 over 30 years before fees

- If your remaining time horizon is lower than at least 10 years you need to diversify risk

A Portfolio with a mix of Stocks and Bonds has not experienced losses if held over 5 years based on the past 30 years of data (this assumes any possible End of Month entry point)

Time also improves returns exponentially - compound interest is the 8th wonder

And any difference in annual return matters even more – the average return difference between Bonds and Gold in a Portfolio with Stocks was below 0.5% but dollar end balance amount difference is over 17,000

In the Very Long run diversification matters less

- A number of investors from the FIRE (Financial Independence Retire Early) Community follow this strategy and generate 8-10% returns on average without diversification (since Bonds and Gold are a drag on performance)

- Over the very long term even minor drags have big consequences (see compounding chart above)

- These investors can stomach high losses (even 40%+) in the medium term without withdrawing any cash

- However, this is not a strategy for 99% of investors who need downside protection

- A good rule of thumb is to use your age as guidance of allocation to Bonds – even the very high risk tolerance FIRE Investors will at some point start reducing their 100% Equity exposure as they age. A different approach is to fill out this questionnaire that asks about your risk profile and your time horizon

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

You are the biggest enemy to your success

Consequences of wrong risk assessment

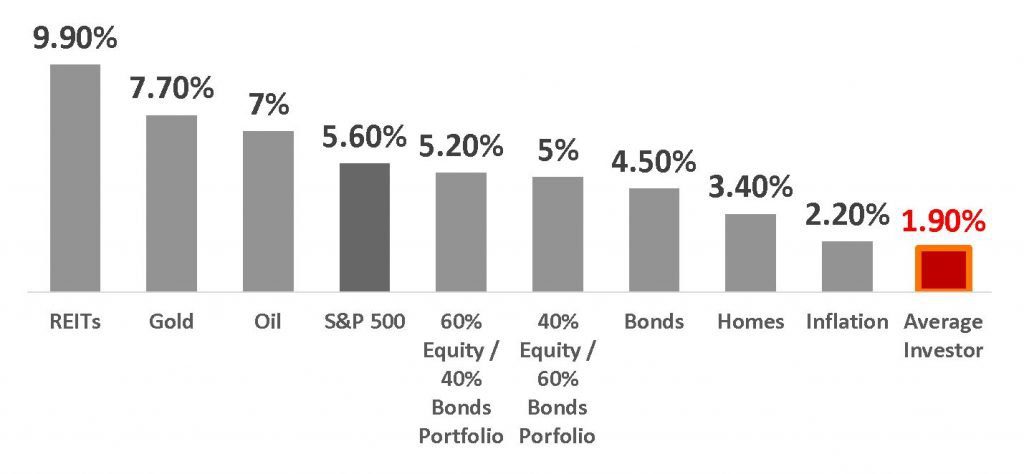

Actual Annual Returns over 20 years (1998-2018)

It’s always darkest just before dawn

- The 1998-2018 Time Period may perhaps be misleading because the first decade was very poor for Stocks (and as a result the 20-year average annual return of 5.6% is well below long term average) but the below graph is a sobering reminder of the potential costs of market timing

- If you think you can stomach losses but actually sell during a sell-off this is what may happen to you

- You will miss some of the market’s best days and lose out on critical opportunities to grow your portfolios with devastating results

- Six of the 10 best days occurred within two weeks of the 10 worst days

Wrong Risk Tolerance Assessment may have devastating consequences

The average investor has achieved a 1.9% annualized return as compared to over 5.5% for the S&P 500 (i.e. just by staying invested in an Index Fund)

Knowing how to react to losses is perhaps the biggest determinant in Investment Performance

It’s very difficult to know how you will actually react before a sell-off happens but again the Vanguard Questionnaire can be helpful starting point in preparing for such scenario with the right diversification

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Diversification is the answer to Short Time Horizon and/or Risk Aversion

Diversification matters and will provide you benefits when you rebalance your Portfolio

Diversification is the only free lunch in Finance

Understand how you can diversify your portfolio e.g. through a simple 2 ETF Portfolio