Best techniques to Rebalance your Portfolio

I must confess, I didn’t think much of rebalancing until I studied it more closely. And from my observations, this applies to a lot of people – even bankers.

I’m not talking about the numbers. Yes, I will show you that it may generate extra returns but more importantly protect you from losses.

The key to me, is that it gives you a sense of control. It matters less what asset you have to protect you – bonds, cash or even gold but more than you can sell it at the right moment to buy cheaper Equities.

That said, I will also give you some practical tips – which rebalancing method yields best returns and how often you should do it. Results may be surprising.

Does the outcome change whether you are a passive or a bit more hands-on investor? Does time horizon affect any rebalancing bonus? And what about the practical implications – transaction fees, contributions and taxes?

Now is perfect time to spend a few minutes on reflecting about long term asset class returns and adjusting your portfolio.

KEY TAKEAWAYS

- Larry and RC have collected 77 investing mistakes that investors commonly fall prey to. Each mistake and the evidence behind it is briefly presented in its own chapter, sometimes using personal stories, along with tips on how to avoid it.

- Even though chapters are relatively short, they are informationally very dense. An effective way for readers to digest the material is to focus on one mistake per day to let the material sink in.

- The mistakes can also be used as prompts for interesting finance-related discussions amongst families, friends, or investing groups.

- There are four parts in this book dealing with mistakes that fall into the same broad theme, which we briefly summarize below.

- This book does not put a particular focus on personal finance, but touches upon how to think about the opportunity cost of spending, how to think about withdrawal rates in retirement, and the importance of saving money early to let compounding work its magic.

Here is the full analysis

The most underrated skill

Why do I need to rebalance?

Rebalancing is probably one of the most overlooked aspects of Investing.

If pedaling is like injecting savings into your portfolio (by far, the hardest part) and wheels are transforming it into returns then what is rebalancing?

As conditions change, gears help to keep the legs spinning at the pace you want. The same goes on with rebalancing. Adjusting the gears so that you won’t injure yourself when facing an uphill battle or strong winds.

Over time your strength may not be the same anymore, at which point the gears you use may change more permanently.

Bulls and Bears - when you need to take action!

Taking action

New investors spend a considerable amount of time researching trade ideas and setting up the portfolio.

At year-end, when seeing asset class performance, we have a tendency in wanting to act. Change the assets, buy higher performing ETFs. Here, not doing anything is often the best course of action.

We also have tendency to react to events especially when things don’t go according to plan. Rebalancing routine can fill that need in a good way (you effectively buy cheaper Equities when the market crashes).

In a nutshell, shifting gears will allow you not to fall off a bike when you face extreme conditions

Above is an example of how the asset allocation can drift during a bull and a bear market given an initial 70% Equity / 30% Bonds allocation.

What if I don't rebalance?

In the worst case, you may jeopardize your goals because the portfolio asset allocation may drift from what you are comfortable with.

Understanding the losses you are willing to stomach is the key to investing success.

Over the long run, especially in today’s low yield environment we may face a situation when Equities and Bonds have vastly different returns.

If you fail to rebalance, the proportion of Equities within the portfolio may increase by compounding. This means higher returns and higher risk. In an extreme situation, over a very long term, your portfolio essentially becomes only equities.

Here is an animated comparison, with 50% EUR-denominated Vanguard FTSE All World ETF Benchmark and 50% FTSE Group of Seven Bond Index hedged to EUR from 1993 through 2019, using two scenarios:

- No rebalancing performed – allocations drift with the market

- Calendar-based (annual) rebalancing is performed

You may not be comfortable with too high/low Equity allocation

In the non-rebalanced portfolio, Equity portfolio allocation drifted significantly from 50% to 40% as Equities crashed in 2008 and then from 40% to 70% in only 10 years.

It’s not hard to imagine how this trend could continue and accelerate given that Bond yields are now much lower than over the past 25 years and put an investor with 50%/50% optimal allocation in a dangerous situation during the next market crash.

Rebalancing, I get it... but what?

Rebalancing needs depend largely on the control you want to have on your portfolio.

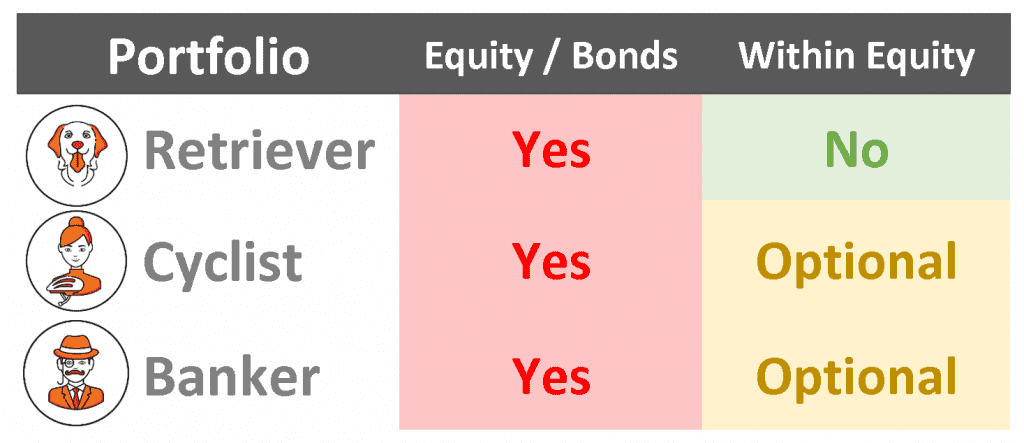

In a previous guide I have introduced three types of portfolios for Long Term investors (a Golden Retriever, a World Cyclist and a Banker). All are in accumulating phase (not retired yet)

These portfolios share the same Bond part – and that’s why, as already illustrated, a rebalancing between Equity and Bonds is almost always mandatory.

The portfolios differ by the granularity of their Equity. If you don’t want to invest like a Golden Retriever way through a World ETF, then you will face another rebalancing decision – within Equity ETFs of your portfolio.

The Golden Retriever doesn’t face that issue, because the allocations within the World ETF are always ‘following the money’ and allocated based on the size of the respective markets.

Rebalancing needs based on portfolio complexity

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Rebalancing within Equities for Higher returns?

Buy Low, Sell High

Let’s start with the optional rebalancing options above, because in that case a regularly rebalanced portfolio can produce superior results to a non-rebalanced portfolio.

For this to happen a few conditions need to be fulfilled:

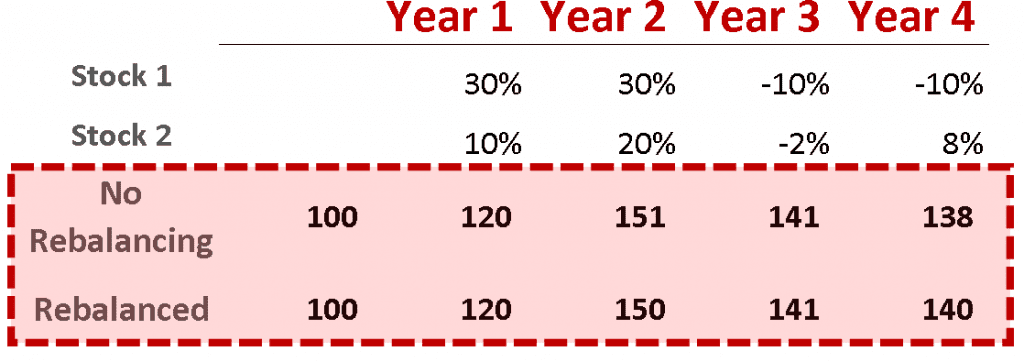

- The two assets (or asset classes) have similar long term expected return e.g. the Stocks below both produce an average 8-9% return over the four year horizon

- The higher the volatility and lower the correlation between them the higher the Rebalancing Bonus

Rebalancing example for assets with similar returns

Condition fulfilled – Despite producing different annual returns, over the 4 year period both individual stocks had similar mean-reverting returns (8-9%)

The rebalanced portfolio produced a superior return, because, you sold high and bought low, starting from Year 2

The non-rebalanced portfolio averaged a 8.45% return while the rebalanced, a 8.7% return, implying an annual re-balancing bonus of 0.25%

A bonus for active investors?

The key issue is the requirement that two assets should produce similar results over a long period of time.

For a rebalancing bonus to be harvested over time, you need:

- A portfolio that is more granular (think Cyclist or Banker portfolios)

- Make at least some active bets (not all investors are happy making forecasts)

- Ideally, the two assets will have fairly low correlation and produce similar high returns

In a nutshell, what fits the picture are two equity asset classes, for example Emerging Markets and Developed Markets.

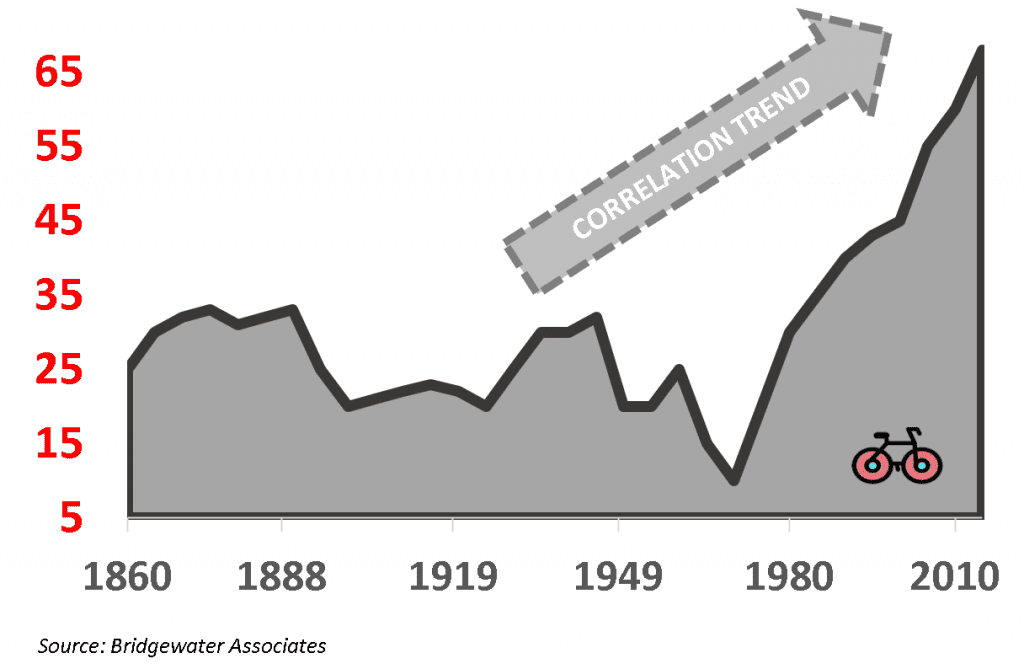

Evolution of average Equity correlation

The Rebalancing Bonus increases as volatility increases and correlations decrease, as demonstrated by William Bernstein.

However, what we know is that across all markets Equity correlations have increased over time, so while the rebalancing bonus is still there (the correlation in my example is 70%, in line with the current averages) , it is getting smaller.

Finally, what if the returns of your two Equity asset classes start to diverge over longer period of time because of structural reasons? In essence, you will stop following the money.

Sticking with Market allocations (like the Retriever implicitly does) or rebalancing the Equity part of your portfolio according to a rule is just one of those additional aspects you have to consider when choosing a Cyclist or Banker portfolio.

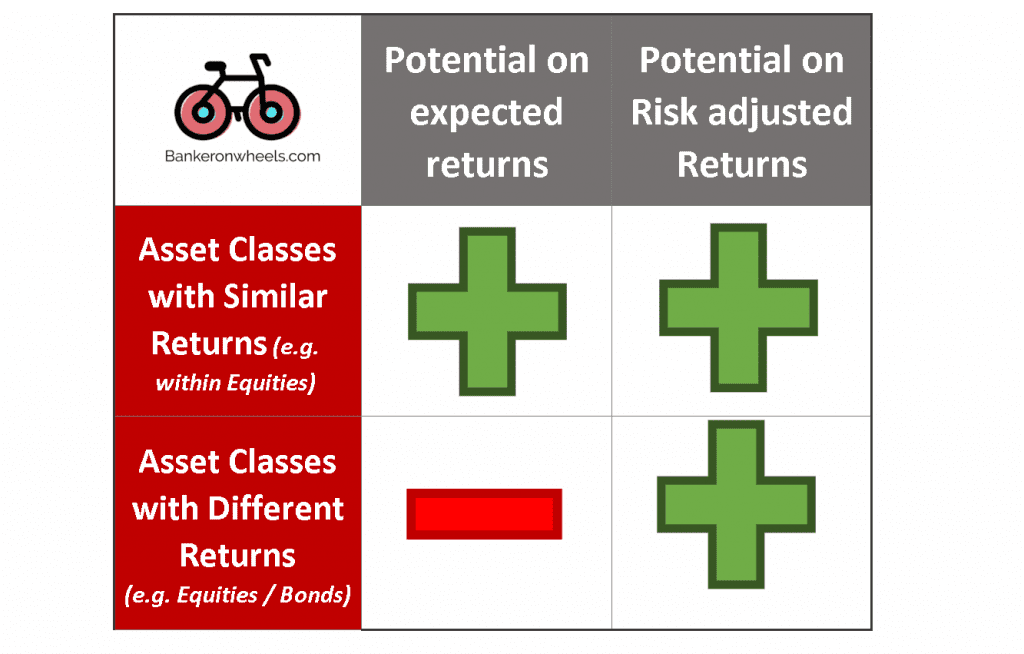

A good night sleep - The real Rebalancing Bonus

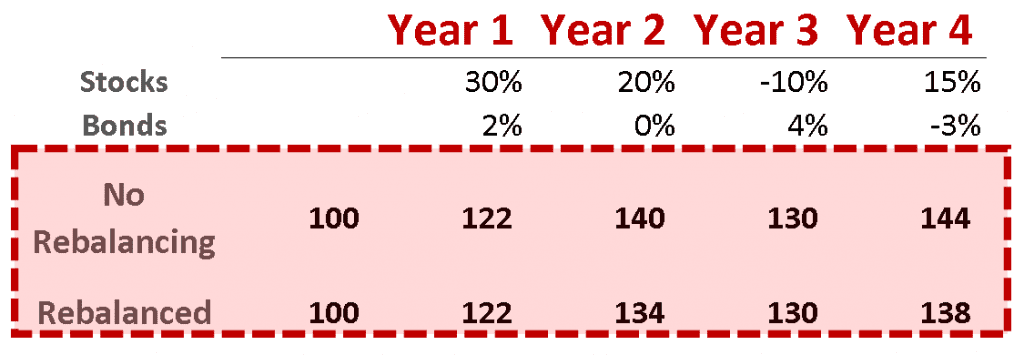

Now let’s have a look at two asset classes with different expected returns (e.g. Stocks vs. Bonds)

As we know, these are the key asset classes from diversification perspective (you can mostly clean up your portfolio from other, less necessary assets).

Non-rebalanced portfolios will, in most cases, produce a higher expected return than a rebalanced ones.

This is because over the long run, Equities have higher returns and compounding will work its magic.

The portfolio will drift towards the high return asset class.

Rebalancing example for assets with different returns

Over the 4 year period:

- Stocks produced an average annual return of 12.7%

- Bonds returned 0.7% annually (a yield not unheard of, if you open a financial newspaper – but don’t waste time on it)

The non-rebalanced portfolio produced a superior, 9.5% return. And this will be typically the case, because in the long run, Stocks always go up (and outperform Bonds)

The rebalanced portfolio averaged a 8.3% return, implying an annual rebalancing loss of 1.25% (but also lower risk from 10.6% to 8.8%, due to a lack of, a higher risk equity-shift that happened in the non rebalanced portfolio)

Keep your emotions in check

The real benefit is that you will sleep well – rebalancing will protect you from your emotional decisions and avoid a disaster

While it won’t, strictly speaking, increase your returns, it will increase your-risk adjusted returns

The other side benefit is purely psychological. Having Bonds or cash and using it during a stock market crash gives us the confidence that over the long term the portfolio will recover because we are dollar cost averaging the entry point into the stock market and this effect alone is potentially one of the most powerful weapons at your disposal during a stock market crash

A great trade-off

While this above example illustrated the concept of rebalancing loss for an Equity / Bond portfolio it is just an isolated case.

A study by Vanguard (based on US data) with returns from 1926 until 2018 found that, on average non-rebalanced 60% Equity 40% Bond portfolio returned 8.74% and outperformed re-balanced portfolios by 0.55% annually.

However, it did increase risk from c. 11.5% to 14% because of the drift towards Equities, which have higher volatility (the non-rebalanced portfolio had an average Equity allocation of 85% over those years) while the re-balanced portfolio kept it around 60%.

On a risk-adjusted basis, the rebalanced portfolios came out more robust.

A quick summary is presented below with focus area for the subsequent section.

Benefit of rebalancing vs. not rebalancing

Best Practices from Academic literature

What is the best method of rebalancing?

A reader recently asked me whether I had data that would guide him on how to best rebalance.

I was thinking of doing some analysis but there is already vast amounts of research, with converging conclusions that point towards certain good practice behaviors.

Below is the best course of action based on academic research assuming you’re in accumulation phase (not retired yet)

How often should I rebalance?

Just as with asset allocation, there is no one size fits all with rebalancing. You may use a calendar method – 85% of asset managers use either quarterly of annual rebalancing. It’s simple and effective.

Major studies point to similar conclusions – the rebalancing frequency, whether monthly, quarterly, semi-annually or annually doesn’t have a major influence on returns, provided you do it regularly:

In his analysis, William J. Bernstein concluded that “No one rebalancing period dominates. Monthly rebalancing was best in three cases, quarterly in four, and annual in three”.

Both, a study by Vanguard and a paper on Opportunistic Rebalancing by Daryanani echoe the conclusions.

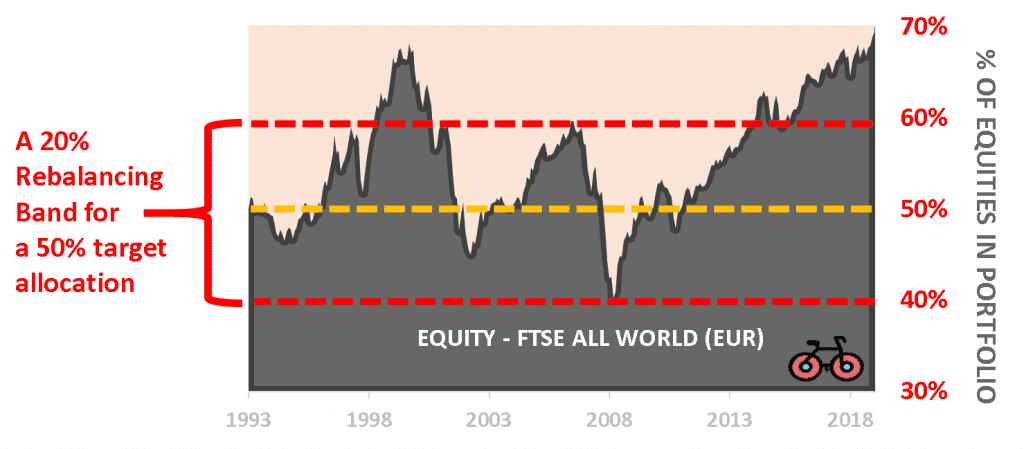

What is rebalancing based on threshold bands?

An alternative to calendar rebalancing is rebalance not based on a time horizon, but instead rebalance based on a threshold for how far out of the allocation is permitted to be, before adjusting it to target.

For instance, a portfolio that was targeted to be 50% in equities might aim to rebalance whenever the total equity exposure grows above 60% (a 20% Band – 10% in each direction away from the 50% target).

The 10% is an absolute value based on the target allocation. It can also be expressed in relative terms, but most readers won’t need this, as it’s targeted for granular portfolios.

Is rebalancing based on threshold bands more effective?

Whether you are an active or a passive investor, there are reasons why this method may suit you.

The psychological aspect to act when a market crash happens – this can’t be emphasized enough. Making crucial decisions at key moments in time is something that calendar-based rebalancing clearly lacks.

In a 2008 study, performed on 5-year rolling returns, Gobind Daryanani found that:

- In trending markets, you don’t generate any rebalancing premium. The lowest rebalancing penalty for a 5-year trending market is rebalancing once the allocation moves outside a 20% band

- In volatile markets, similar to 2000-2010, a rebalancing premium is also observed. Interestingly, this premium is highest when allocation moves out by 20%

- A too narrow band, yields lower rebalancing premium because it doesn’t allow to harvest the momentum the outperforming asset class is building. A minimal band also incurs costs that offset any benefit

If you have a long term horizon, the main take-away from this analysis (since it’s limited to 5-year investment horizon) is that setting a one-way threshold of less than 10% (or 20% total band) from the target allocation is not efficient. This method is not necessarily better than a calendar based (see Vanguard research below) but may require lower portfolio maintenance, since large moves are less common. The downside is that it’s more hands-on since it necessitates tracking of asset classes.

If you have medium term investment horizon, and a Banker-type portfolio, with e.g. five asset classes (Large Caps/Small Caps/REITS/Commodities/Bonds) like in this analysis, the conclusions are even more interesting. Since the analysis blends a number of asset classes (and mean-reverting asset classes can produce a premium) you may indeed capture a rebalancing premium.

Can I combine the calendar and threshold methods?

Yes, and this may be the most time-efficient and hassle-free way of managing a portfolio for Long Term passive investors.

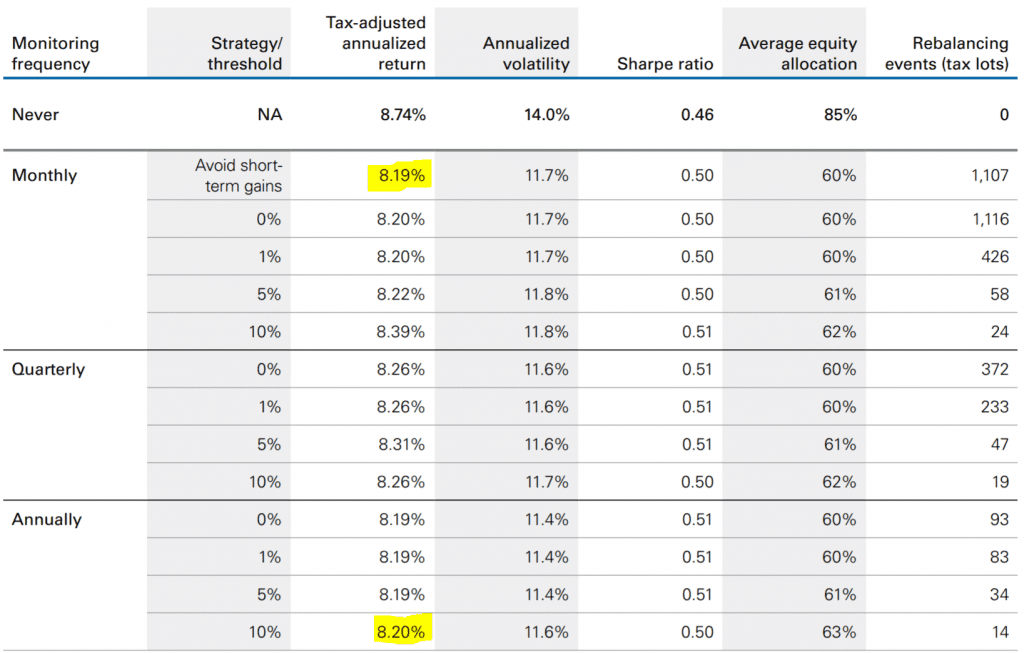

In the 2019 study, on a large 1926-2018 dataset, and analyzing rebalancing between Equity/Bonds Funds (think Retriever portfolio) Vanguard has combined both methods using the following logic:

- Look at the portfolio (Monitoring frequency) monthly, quarterly or annually

- Act only if the asset class deviates such as the upper or lower rebalancing band is hit (Strategy/threshold)

- The surprising conclusion is that returns don’t differ even in the most extreme scenarios. Whether you automatically rebalance monthly, that is calendar-based method ignoring any bands, with 8.19% return (Monthly / 0%) or are hands-off as much as possible (annual review and only act if the asset class moved by more than 10%) with 8.2% return (Annually / 10%).

What about cash injections, transaction costs and taxes?

- Use regular cash injections to move your allocation towards target without incurring additional transaction costs. The same applies to withdrawals.

- Tax wrappers should contain a mix of asset classes, because rebalancing within these accounts is tax-free

- In taxable accounts, strategies such as rebalancing first with higher-cost-basis shares may improve portfolio returns

- Infrequent rebalancing also allows for lower transactions costs

Rebalancing to target vs. changing allocation

Apart the elusive (for passive investors) rebalancing bonus, there is the question of making sure the gears are optimal.

Rebalancing between Equities/Bonds (and Cash/Gold if you don’t want to hold only Bonds) usually means bringing the allocation in line with your target risk profile. Most of the time it will be similar year over year.

The only exception is if your life circumstances change over time e.g. you have more accumulated wealth from other sources and willing to take more risk (and can let the equity part drift – become bigger part of your portfolio).

Another situation is when you have urgent spending needs and you need to be more careful with risk you’re taking.

You can take a questionnaire annually to understand what Stocks/Bond allocation you need. But knowing how you will actually act in a crisis is the secret to achieve the best risk-adjusted returns.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Conclusions

A rebalancing method is an individual choice.

Personally, I really feel good about buying cheap equities during a stock market crash so I do opt for threshold band method when my allocations drifts considerably. Otherwise, I remain pretty lazy and won’t look at allocations more than once a year.

Interestingly, over the past few decades Stocks and Bonds have frequently returned somewhat similar returns.

This has in fact led to some surprising situations where, in volatile market environments (e.g. 2000-2010), portfolio rebalancing may have resulted in a rebalancing bonus even for Equity and Bonds.

However, because of Bond yields at record lows, the discrepancy between these asset classes will be at least a few percentage points which means that from a long term passive investor perspective, a rebalancing bonus will likely remain negative.

But what’s more important is that academic research consistently points to the fact that it always allow to control for potential losses.

That said, it’s rare to see evidence that active investors may be better off than passive investors. Rebalancing could be such a case. With algorithmic trading accounting for 4 out of 5 transactions which may exacerbate market crashes, well-executed rebalancing may bring additional returns.

If you enjoyed this, you may like reading how rebalancing plays a role when you want to take advantage of the next recession.

REFERENCES

- William J. Bernstein, ‘The Rebalancing Bonus – Theory and Practice’, 1996, EfficientFrontier.com

- Gobind Daryanani, ‘Opportunistic Rebalancing – a new paradigm for Wealth Managers’, 2008, Journal of Financial Planning

- Vanguard, ‘Financial Planning Perspectives – Going Back on Track: a guide to smart rebalancing’, 2019, Vanguard

- Colleen M. Jaconetti, Francis M. Kinniry Jr., Yan Zilbering, ‘Portfolio rebalancing in theory and practice’, October 2010, Vanguard

- Robert D. Arnott, Robert D. Lovell, ‘Rebalancing: Why? When? How Often?’, Spring 1993, The Journal of Investing

- The Economist, ‘The stockmarket is now run by computers, algorithms and passive managers’, October 2019, Economist.com

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – BlackRock Launches New iBonds, Truth About €1M Broker Insurance & BOW is 4 years old!

The Truth About €1 Million Broker Guarantees

4 Things I Learned In 4 Years Of Running A Finance Blog

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.