Menu

Bankeronwheels.com is unlike most Investment websites you have come across

Bankeronwheels.com is unlike most Investment websites you have come across

The Stock Market is a powerful money-making machine that can make you rich and

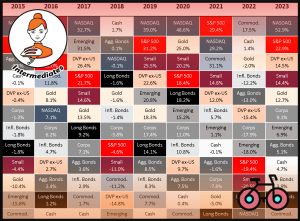

Which major asset class has generated the strongest returns over the long run? How do the returns of investments like bonds and real estate

If you read about Investing from a US source you know how easy it is to invest in North America

And yet in Europe and

When choosing a broker, investors face a myriad of considerations, from safety measures to fee structures and beyond. Bankeronwheels.com takes a unique approach to

iWeb Share Dealing is the typical boring, but cost-efficient platform with good ETF availability. But make no mistake, it is an excellent option for

AJBell is a Tier 1 broker with a good reputation, long track record and competitive fees. Only the most advanced investments are beyond the

The Stock Market is a powerful money-making machine that

Bankers are a rational bunch unless you talk to them about Football or Gold.

Gold

2022 reminded us that trees don’t grow to the

Expats face unique challenges – financial regulations of both

We live in extraordinary times. Just a decade ago,

If you read about Investing from a US source

ETF Domicile is not very glamour. And something that

Navigating the world of bonds can be a treacherous

From March 2024, Xtrackers MSCI World ex USA UCITS

Some ETFs track the same benchmarks as well-known Money

When choosing a broker, investors face a myriad of

iWeb Share Dealing is the typical boring, but cost-efficient

AJBell is a Tier 1 broker with a good

What Is IBKR Fixed Vs Tiered Pricing? Fixed pricing

Freetrade markets itself as an ETF-friendly platform with very

Get FREE access to our best investing resources. Likely the single best newsletter for individual investors in Europe.

Unsubscribe at any time.

Don’t spend your entire life working a job you don’t love so that you can maybe retire at 65. Make your money work for you while you sleep.

Most of what’s published and shared about money is either wrong or so old school that it’s obsolete.

Given a reasonable time horizon and if you follow the right principles, you have, by historical standards, no chance of losing money. Join our newsletter today to improve your odds of reaching financial freedom sooner.

Don’t spend your entire life working a job you don’t love so that you can maybe retire at 65.

Make your money work for you while you sleep.

Given a reasonable time horizon and if you follow right principles you have, by historical standards, no chance of losing money.

Join our newsletter.

Get free access to our best investing resources. Likely the single best newsletter for individual investors in Europe.

Unsubscribe at any time.

Copyright © 2020-2024 Bankeronwheels.com. All rights reserved.

Sitemap |Privacy Policy | Terms and Conditions | Coaching Terms and Conditions | Contact | About | Transparency| Cookies