Yes, you should. Based on Research, 2 out of 3 times investing Lump Sum immediately is better than Dollar Cost Averaging (with 2% incremental returns over a 12-month period)

Here is what you need to know about Dollar Cost Averaging and Lump Sum Investing:

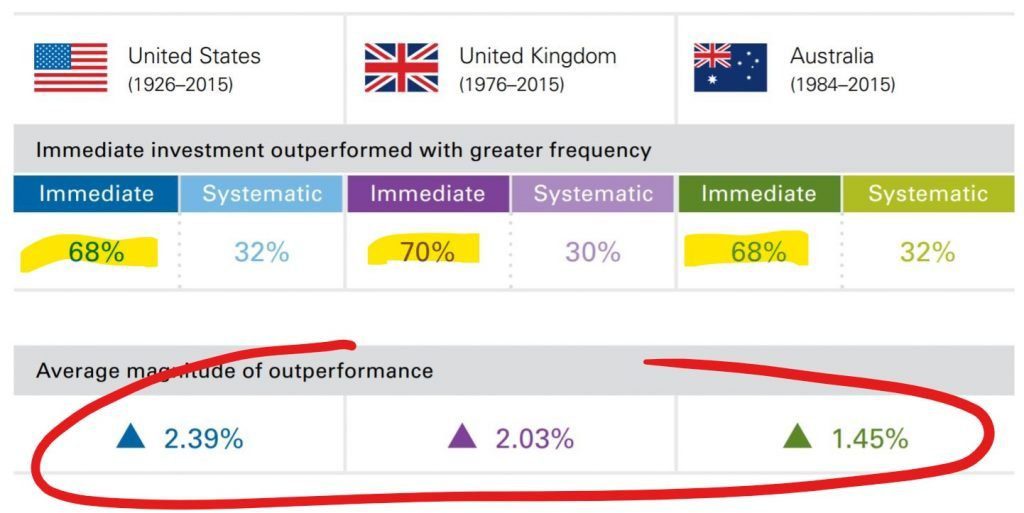

- Vanguard research proved that it doesn’t pay to wait and try to dollar cost average

- However, you may try it to avoid any regrets in a downmarket

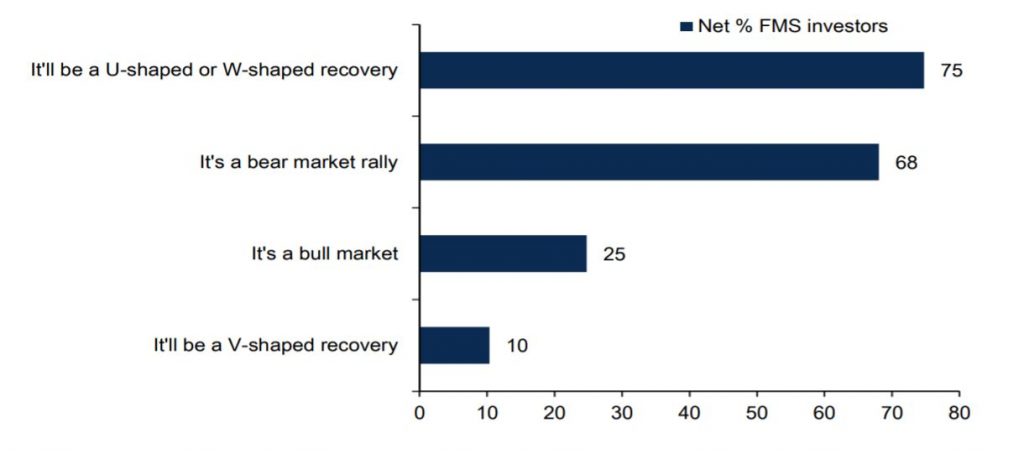

- Even professional investors don’t know if we are still in a bear market

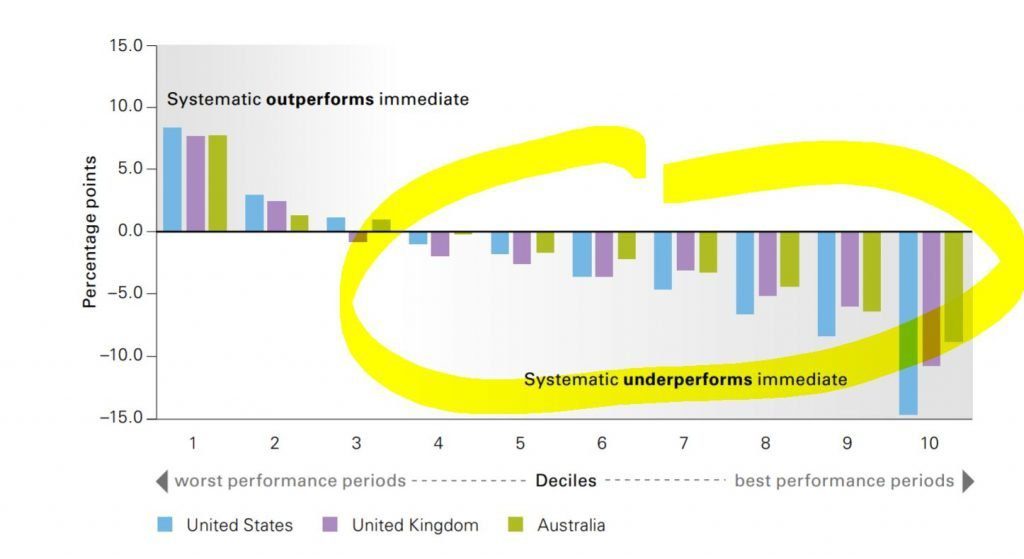

- Only ~30% of time will this strategy work but on average you pay a price for it since cash is a drag on portfolio performance

- If you try to Dollar Cost Average: (i) be disciplined and (ii) don’t do over more than 12-months

Vanguard has compared outcomes in 3 countries and in each case immediate lump sum investing comes out better (68% to 70% of cases) than systematic (i.e. dollar cost averaging) with a significant 12-month portfolio outperformance:

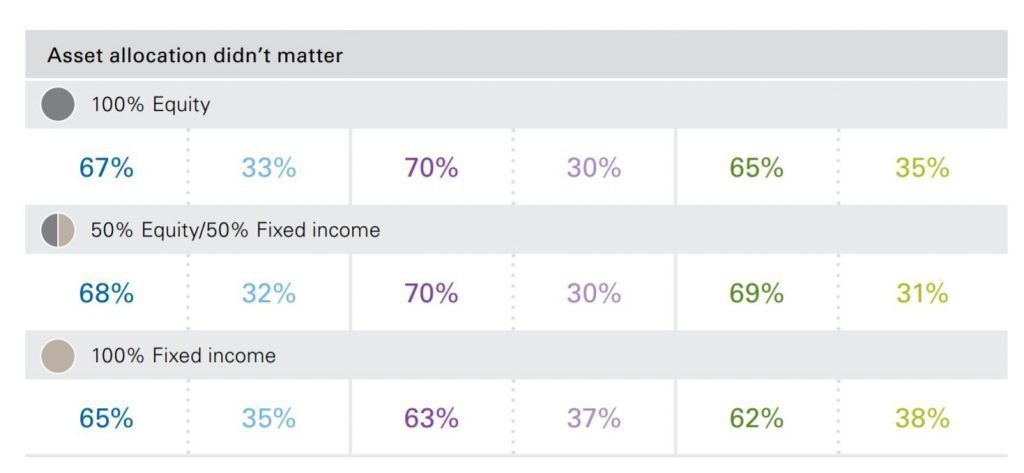

Your Asset Allocation doesn't matter - in each scenario it's better to deploy a lump sum

But should you proceed with Dollar Cost Averaging down in Coronavirus Bear Market?

As highlighted above there is over 60% chance this won’t increase your returns (are in yellow). But there is a slim chance that it will especially in a Bear Market (the area NOT in yellow)

The case for Dollar Cost Averaging down? Regret Aversion

Are we in a Bear Market though?

Historical Analysis proves that on average you will pay the price for mental comfort of Dollar Cost Averaging. However if you do decide to do it, Vanguard has two important messages from their analysis:

- Stick to the discipline and invest on a regular monthly basis over 12 months

- Don’t spread it out over more than 12 months (you can’t beat the lump sum investment over a longer time period)

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Conclusion: Research proves it pays to deploy a lump sum and put money to work straight away

Source: Vanguard