Come Along For A Hike With Francesca: How to Start Investing In 10 Steps.

Trail Talk: 10 Steps to Kickstart Your Investing Journey.

A while back I was on a hike with friends and after talking about some exciting topics like cycling the world, the conversation ended up drifting towards investing.

Francesca and Joanna were buzzing about Index Funds, fresh on their radar. But both were reluctant to deploy money in the Stock Market.

Francesca’s cash stash was gathering dust, while Joanna swore by her home’s value.

I vowed to scout a list of ETFs for them. But, sharing our trail talk might just be the golden nugget you need. Diving into investing? It can feel like scaling a cliff.

Here’s your roadmap: 10 punchy steps to kickstart your investment journey. Heads up: steps #7 and #9 are where the real trek begins.

#1 Double Your Money in The First 10 years.

What's the worst case?

You probably end up flat.

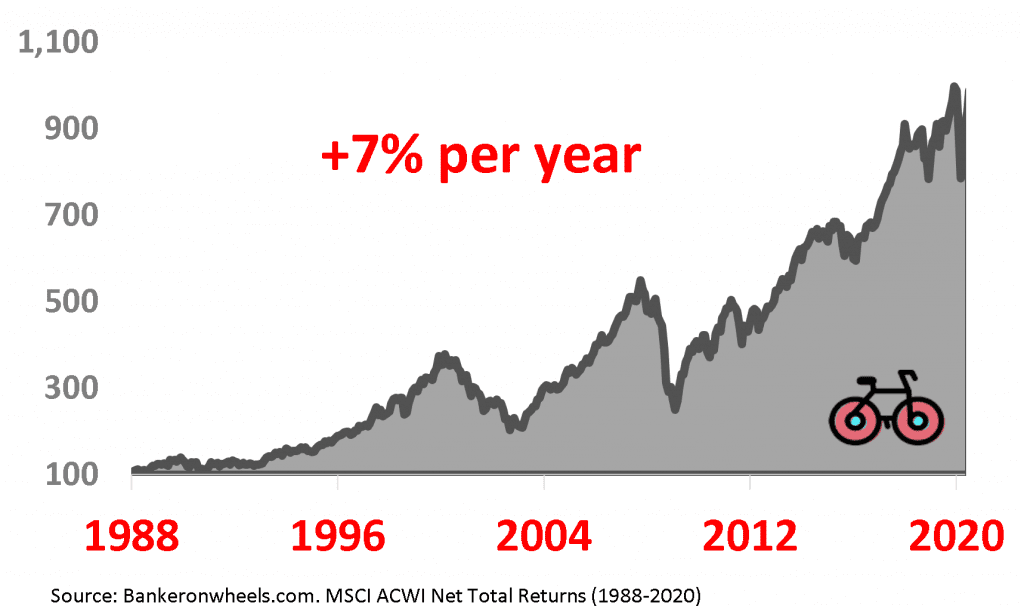

If you’re relatively young, and follow wise investing rules, your Equity portfolio may, on average, earn around 7% per year. You could be unlucky and pick a lost decade – like the early 2000s, and end up flat. But, it’s quite rare, so odds are on your side.

Much more often, you will double your money in the first ten years. The best part? From there, your portfolio grows exponentially.

Do a simulation in my compounding calculator to understand the magic of investing early.

Even Warren Buffett tips his hat to this trick, crediting his colossal wealth to a mix of American opportunity, a dash of luck, and the relentless power of compound interest: “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Global ETF Total Return (1988-2020)

#2 You do NOT need Skills.

Where do you need skills?

In real estate, not in the stock market.

This is one of the biggest misconceptions about the Stock Market. In fact, applying your knowledge may end up being a disadvantage, as you will see in the rule #6 below.

I could turn Joanna’s argument against her. You actually need skills to invest in Real Estate. It requires time, research, oversight and maintenance.

What about the market Crashes?

You can outsmart most investors. Including Wall Street.

Joanna was concerned about losing money in the Stock Market and thought that investing can’t compete with the Property Market. She must have heard of the most epic stock market crashes.

Yet, if you follow wise investing rules, you won’t lose any money in the long run. Why?

- The Market Bounces Back, Always. As long as you have a global diversification. That’s because, you own real companies, and are entitled to part of their earnings. Think of the smart, hyper-competitive and incentivised with Stock Options folks from Google or Microsoft/Open AI clocking in each Monday Morning to boost your bottom line. As economies expand and profits surge, so does your wealth. And profit margins increased relentlessly over the past decades.

- Tune Out The Hype. If you are a Golden Retriever and understand your portfolio, you will sleep tight, and won’t sell during sell-offs. The financial press thrives on drama; don’t let it sway you. Peek at your portfolio quarterly, no more.

- Ease In Smartly. In theory, investing a lump sum in one go is most efficient. Psychologically, injecting on a regular basis over a 12-month period is a good strategy. Especially as a beginner in a bull market.

- Plan For Contingencies. Make sure you don’t invest the money you will need in the short to medium term. Create separate sub-portfolio for these goals.

can you live off your portfolio?

yes, but Not off your own house.

There is much hype about passive income. Does it really exist? You can’t live off your own house and buy-to-let is not passive. What about the stock market?

If your Investment Portfolio has the size of 25x your annual expenses you may consider retiring early. Or pursue less lucrative passions.

In 1994, William Bengen came up with the 4% Rule which means that you can safely spend 4% of your Investment Portfolio. This guy explains how.

#5 It's Not a Casino. In This Game, Red and Black both Win.

Can you pick a bad fund?

With ETFs, you almost always win.

Francesca had a portfolio of 4–5 ETFs covering specific countries and sectors. She wanted to maintain exposure to some African countries. But she was surprised to discover that you can start with one ETF to invest in most stocks, and be diversified. Worldwide. Here is how.

What about ETF Providers? Are they safe? Unless you go with active funds, where the portfolio manager’s career goals and outflows may ruin your plans, most passive funds are from reputable companies with rigid rules to follow.

If you are in for the long run, and are not interested in digging further, you may pick one of those two:

- Red – is the colour of Vanguard that made Index Investing popular amongst individual investors. They are the most retail-friendly.

- Black – is the colour of BlackRock, the largest Asset Manager in the World. Its ETFs are known as iShares. They are as cheap as Vanguard’s.

Can you lose your money with any of them?

Your shares are held in a custodial account, so it’s bankruptcy-remote from the Asset Manager. My top choices for Francesca are in the World ETF section. For African economies, Francesca may allocate a tiny part separately. Tiny frontier markets are usually not part of Global ETFs.

Nobel Prize winner William Sharpe found that a market timer must be right a staggering 82 percent of the time to match a buy and hold return. That’s a lot of work to achieve what could be achieved by taking a nap.

Christopher Browne, author of The Little Book of Value Investing

Your Stock-Picking Cousin Doesn't Stand A ChanCe.

In the long run, Only 4% of Stocks drive all returns.

Neither Francesca nor Joanna want to pick stocks.

But Stephan, who joined the hike, works at a German newspaper and selects some of the hottest BioTech stocks for his readers. Even some of the smartest Retail Investors are taking a gamble from time to time.

It’s fun. It’s educating. But it’s a loser’s game. Why? Because it’s not a 50:50 game.

What may shock you, is that only 4% of all firms led by Exxon, Apple, Microsoft, General Electric or IBM drove all stock market gains over the past decades. Finding them is like looking for a needle in a haystack.

It gets worse. 6 out of 10 stocks have generated negative wealth for Investors. Not convinced? Look at these 9 charts.

But you're better than your cousin, aren't you?

If you can't spot the sucker at the table, then you Are the sucker.

even pros struggle to pick The few winners

Here is how the game works:

- Someone Needs To Lose – Financial media will make you believe it’s easy to pick tomorrow’s winners. But winners constantly change. Just look at the chart above. Wall Street wants you to play the game by its rules. You will compete with thousands of investors with cutting edge technology. For professionals to win – they do outperform the market before accounting for their fees – someone else needs to lose. Why do you think you’re invited to the table?

- Soon, You Will Regret It – Once you fall down the rabbit hole. Most people ignore the work that goes into Active Investing until they are pregnant with it. Decided when to buy? Relatively easy. Now, figure out when to exit. Model intrinsic value. Size your trade. Optimize taxes. Transaction costs. Optimise for correlation with the rest of your portfolio.

- You Will Lose Time – Your most precious resource.

You can’t be smarter. But you can set your own wise investing rules and win.

#7 Good Investing is Boring.

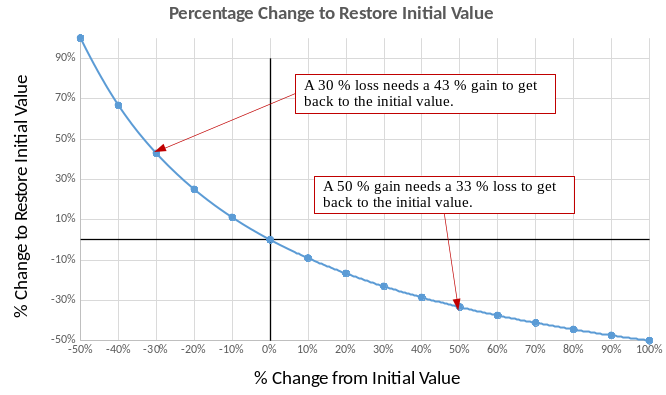

Once you lost Money, it's over.

There may be no come-back.

Francesca didn’t like Bonds, because Bonds are boring. Having 5-10% of Portfolio in play money to buy stocks is great to understand how markets work and make it entertaining.

But, you can’t allow yourself to lose the remaining 90% invested in ETFs. There may be no come-back.

The math is brutal. By losing money, not only are you not making compounding work for you, but you need exponential returns to just recoup your losses. If you invest €10,000, and you lose 50% you now start with €5,000 that needs to double (100% return) just to get back to the initial balance. Selling during a Market Crash is crystallising losses.

Markets move fast. Historically, six of the 10 best days occurred within two weeks of the 10 worst days. Missing out on them can have devastating consequences.

Exponential Consequences of Losing Money

What can you do?

your homework starts here.

Now, here is the tricky part. Buying and Holding a couple of ETFs is probably the toughest investing strategy. Emotions always want to take control. Investors, whether sophisticated or regular savers, think they can time the market. FOMO kicks in.

As a beginner, you have no idea if you will have the stomach not to sell.

Here is what you can do to increase your odds:

- Assess how risk-averse you are. Not only through a Risk Questionnaire.

- Think about when you will need the money. A 5-Year Investment Portfolio needs less volatility than a 10+ Year Allocation.

All this determines the part of Boring Assets – a mix of Cash, Nominal Bonds or Inflation-Linked Bonds or even some Gold. Today, Francesca likes Bonds more, so I have suggested an ETF that can be combined with her Equities. A boring cash-cow.

#8 Isn't Bitcoin a faster way?

Should you have skin in the game?

Maybe. But be ready to lose it all.

Cryptocurrencies as an asset class represent $1.5 Trillion Market. Having a 5% allocation is not unreasonable and may boost your portfolio returns in the long run. Anything above that and your portfolio becomes more of a gamble than being driven by real companies. Here is why.

Even with a 5% stake remember, it’s not backed by anything, but an algorithm. Be ready to lose it all.

#9 But choosing a broker is difficult.

Consider fees, but also safety.

This requires a bit of research depending on your country. Fees are important but safety is even more. You will likely get your shares and money back in case the Broker goes bust. But there could be opportunity costs.

Learn how to choose a Safe Stock Broker. In certain cases, you may want to diversify across a few of them to take account of your country compensation scheme limits.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

#10 You probably don't Need a Financial Advisor.

Are most people better off without an advisor?

There is a lot of bad advice out there, be cautious.

Most people are better off without a Financial Advisor. It’s expensive and there is a LOT of bad advice out there. This may be different if your situation is complex and you need e.g. tax optimisation advice. Otherwise, grab an introductory Investing Book. Then read through the ETF materials on Bankeronwheels.com.

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.