COVID-19: Keep investing even if your monkey brain wants you to stop

Sometimes we may base our decisions on fear but we need to keep being rational. Earlier last year I was in Hokkaido’s bear land close to a region with the highest density of grizzlys (yes higher than Alaska). I put my tent to sleep in the bear country because rationally the chances of dying were low. We must do the same with investments when markets tank.

Above is a picture of a Japanese Brown Bear statue taken in Hokkaido during my cycling trip last year – don’t fear the bear market and as the Japanese sign says – just fasten the seatbelt (ah, the Japanese sense of humour)!

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Fear and Investing

James Montier from GMO Investments recently described a research based evidence on how our brain works when faced with fear. It is important to keep this in mind especially if you have a strategy to deploy funds if/when the market takes a plunge.

The game is as follows: “At the start of the game each player is given $20 and told the game will last 20 rounds, each of which involves winning or losing based on the result of a coin flip. Before each round each player is asked if he or she would like to invest $1 to play. If the answer is yes, then the $1 is ‘invested’ and a coin is flipped. If it comes up heads, winners receive $2.50; if it comes up tails, the dollar wagered is lost.

The expected value is $1.25 per round, giving a total expected value over the course of the game of $25. In fact, there is only a 13% chance that a player finishes the game with total earnings of less than $20, which is, of course, the initial endowment and the amount kept if one doesn’t invest at all. The second thing we know is that the outcome of a prior round shouldn’t impact the decision to invest in the next round – the coin has no memory (although we humans do)”

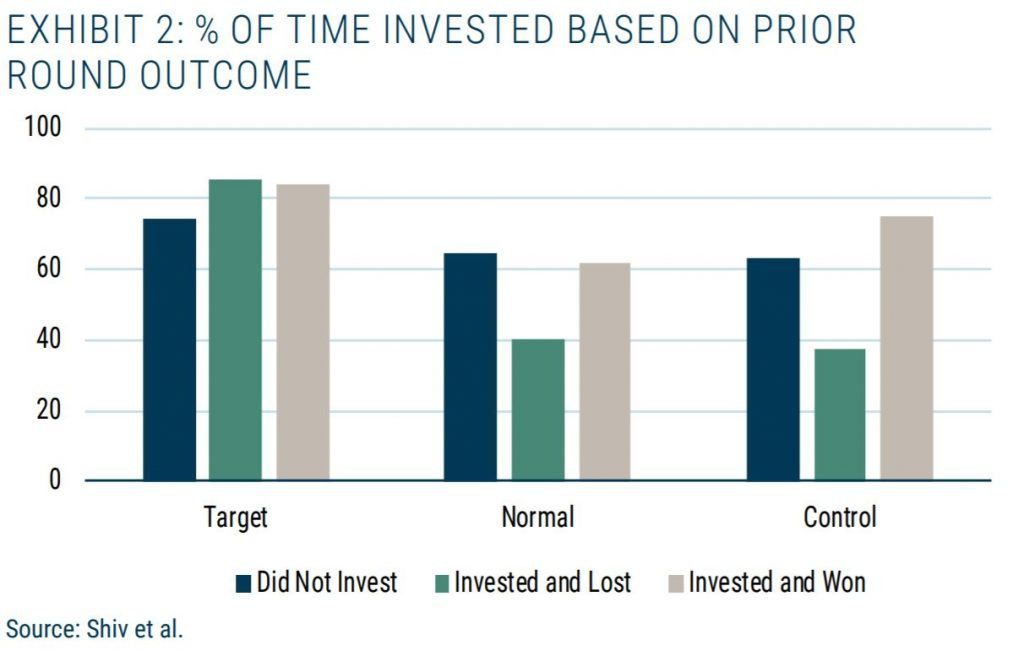

Now look at the below chart – this is how the brain actually behaves when faced with losses in a prior round. As Montier notes “The group labelled ‘Target’ have a very specific form of brain damage that effectively renders these individuals incapable of feeling fear”

In essence the Target group are rational investors, the Normal group are most of us.

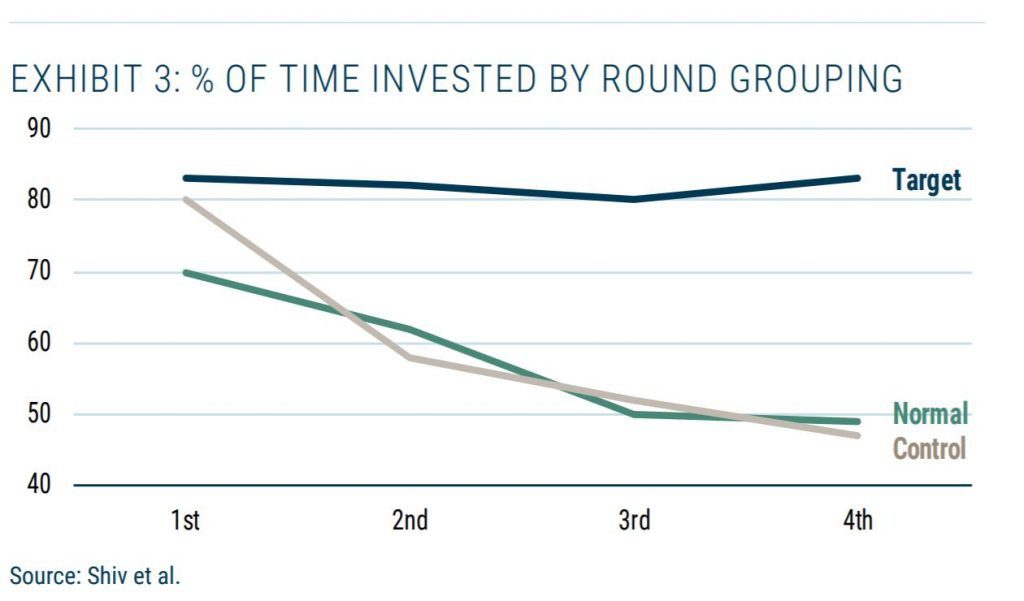

It gets worse as the fear compounds as we increase the number of rounds as shown below

Montier leaves us with this story: “It is said an Eastern monarch once charged his wise men to invent him a

sentence, to be ever in view, which should be true and appropriate in all times

and situations. They presented him with the words “And this, too, shall pass

away.” In line with the deep believes of the writer of this blog (Stoic philosophy seems adapted to investments!)

You can also listen to Montier’s recent great interview for Bloomberg Radio

Review here the other rules to follow when deploying capital in a Bear market.