[Updated in July’20] During the March Stock Market Crash pretty much all my family members and some of my friends asked me how to invest in stocks. Given the current market turmoil, there is an increasing appetite for buying stocks.

These are the 10 Rules they have learned should another crash materialize (e.g. should the liquidity problems turn into solvency problems in the wider economy later this year)

1. Invest in Stocks gradually on the way down

When and how to invest in stocks? If you have directly or indirectly prepared for a period of financial stress and have available cash you may consider starting investing when there is a market crash.

A good strategy is to build rules and stick to them — either based on certain index levels e.g. S&P 500 at 2700 invest 20% of savings, 2500 another 20% etc. or based on timing (slicing every few weeks since you will never have clarity which way the market may go and when it will bottom out)

2. Do not chase an upward trend in a bear market

One of the common mistakes we see is people chasing upward trends because of FOMO — Fear of Missing Out (when stock market recovers after a big crash for a few days giving hope of long term gains).

It takes more courage to buy according to predefined rules which often means buying when everything is gloomy and stocks lose massively. Buy on days when stocks are massively sold not bought. In the long term it pays off. Do not be tempted by rebounds that may prove short-lived.

Even the best investors struggle with market timing. In fact most hedge funds (even the most prestigious ones) made substantial losses in March

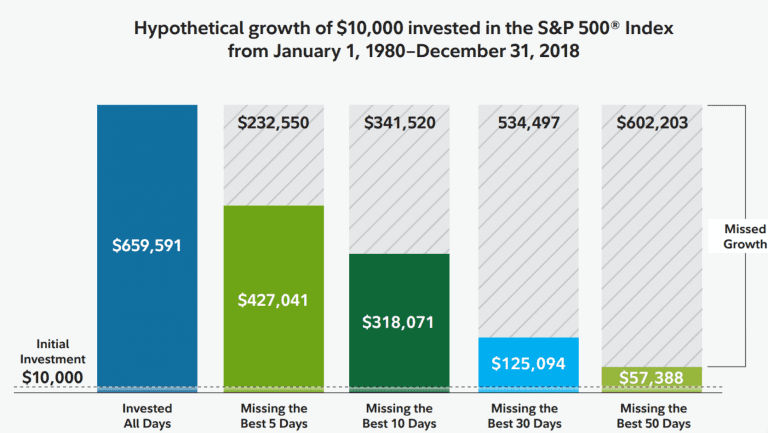

The market can turn rapidly both ways and while you may avoid some bad days avoiding just a few good days can be extremely detrimental to your long term performance as illustrated by a study done by Fidelity.

Also, it is extremely risky to use leverage since additional debt implies you must be correct on timing

You may not get spectacular 300–400% returns overnight but your money will be relatively safe if you base your decisions on sound financial statements and diversify. You can follow Wise Money with ETFs that are a great way to invest in indices without taking idiosyncratic risk (e.g. Luckin Coffee dropped 80% in one day in March on uncovered fraud — as Warren Buffett says “Only when the tide goes out to do you discover who’s been swimming naked”).

Ask yourself the question — am I more qualified than a professional investor to predict which industry player may outperform the rest of the market?

Do I know how the landscape post-crisis will look like? Even if you suspect knowing first-order effects are you sure of the second and higher-order effects (to Nicholas Taleb’s point)

5. Avoid binary outcomes

How to invest in stocks to avoid drawdowns? Each crisis has its own most vulnerable industries where outcomes can be binary — in 2008 some Banks went out of business and as an investor, you may have lost everything. The Coronavirus crisis has other prime candidates for such outcomes, airlines can be nationalized and hotel/tourism industry players can go bankrupt should the distress last longer. You want to avoid these investments until there is more clarity on consumer confidence

Since these recover now you may think it was wise to invest at some point but the key is that you can’t base the rightness of a decision based on an outcome but on a probability it would occur. And in March chances were high there would be lots of Airline Lehman Brothers (in fact, a lot materialized — LatAm, Virgin Australia, etc)

If you do invest in single names, do not believe blindly in potentially meaningless dividend yields based on past data unless it has been confirmed by the management after incorporating all the outlook related to Covid-19.

Instead, look at balance sheets with low debt and build-in resilience (cash). These firms may outperform and even acquire weaker competitors in the current environment. Be cautious though, you can’t predict the impact of post-Corona market on Business Models

7. Keep Some Cash

Ray Dalio now infamously said a few months ago that ‘Cash is Trash’. While he is one of the best thinkers in Finance the remark was badly timed. Even in the most conservative scenarios keep some reserves. This is primarily a health crisis and while an economic crisis unfolds having a safety net is paramount.

Additional unforeseen tail risks always exist (think Oil Price crash or Trade War on top of Coronavirus etc)

8. Diversify in other assets including currencies, commodities and high quality debt products

It is difficult to predict which countries may relatively outperform. Keep your portfolio diversified geographically (e.g. Asia, Europe, US) and product-wise potentially including commodities like Gold that may outperform in low real rates / high inflation environments. Consider very high-quality debt products. Here is a good guide on how to protect your Stocks Portfolio.

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

9. Stay informed but remain cautious

Knowing how to invest in stocks is also about adjusting your strategies as there is more clarity about the outlook. But be very careful with financial experts and consensus — when you see opinions converging usually something else will happen

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

iWeb Share Dealing Review – Great For Inactive Investors

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.