How To Choose The Best Stock Broker?

Why Is Our Guide Different? This guide is Bankeronwheels.com’s deep dive into European and UK Brokers. We approach Brokers by: ETF Focus – We are long-term […]

Why Is Our Guide Different? This guide is Bankeronwheels.com’s deep dive into European and UK Brokers. We approach Brokers by: ETF Focus – We are long-term […]

As we prepare our pipeline of articles and ideas for 2024 it’s time to summarise what you liked in the prior 12 months.

Here are some of our most-read posts of the past 12 months.

2023 marked the third full calendar year of Bankeronwheels.com.

We truly appreciate all support received and will work hard to make 2024 more impactful!

Definitive guide to choosing a stock broker – Part 5 This is part 5 of Bankeronwheels.com Definitive Guide to choosing a Stock Broker. ‘Free trading’ often […]

As we find ourselves just a few weeks away from Christmas, I am both thrilled and humbled to present to you a foreword I had the immense honour of writing for a book that is as unique as it is insightful.

Compounding is a powerful wealth-creation tool. But taxes and fees can sabotage your plan.

Typically, up to 2-3% of the 7% average annual total return from Global Stocks comes in the form of dividends. But what happens to compounding if we distribute them?

Today, let’s look at how to optimise your ETF selection for the compounding magic to work without leaking too much in unnecessary taxes.

I was initially sceptical towards Synthetic ETFs. Back in 2009, I analysed client portfolios of CDO and CDOs-Squared – some of the most complex, and toxic, financial instruments ever assembled by Wall Street Banks. After working-out structured finance portfolios, synthetics raised my eyebrows.

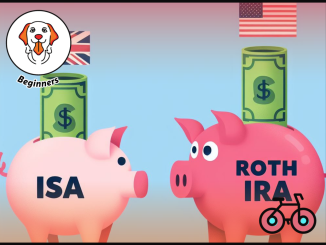

You’ve likely heard the buzz about the Roth IRA from US investing circles, tantalizing savers with its tax-free growth and withdrawal benefits.

While this famed investment vehicle is sadly out of reach for UK residents, fret not!

Let’s dive into the Roth IRA Equivalents for UK Investors.

Imagine discovering your broker has gone belly-up overnight, leaving your hard-earned investments in the balance. In a market where investors tirelessly chase after low fees, the often-ignored specter of broker failure lurks in the shadows.

The collapse of a broker isn’t just a plot twist in a Hollywood blockbuster—it’s a stark reality that has left many investors stranded and panicking.

Could your broker be next? What safeguards do you have in place?

Here is what you need to know to protect your savings.

Most investors starting out would be confused to learn that, for example, investing in an MSCI World ETF wouldn’t provide them with a Global exposure.

Equity ETFs can be confusing due to Index Providers’ naming conventions. So, I had a deep dive into how they work, and I hope you can also benefit from it