Interactive Brokers Fixed vs Tiered Plan – Which Is The Best For ETFs?

What Is IBKR Fixed Vs Tiered Pricing? Fixed pricing is easier to understand. Tiered pricing formula is more complex and exchange-dependent.

What Is IBKR Fixed Vs Tiered Pricing? Fixed pricing is easier to understand. Tiered pricing formula is more complex and exchange-dependent.

Brokers are usually bucketed together by comparison sites, that don’t have an in-depth knowledge of trade-offs related to fees, transparency and counterparty exposure. Most of the websites are also conflicted, often promoting brokers with the highest-earning commissions.

We take a more rigorous angle. How would a wise long-term investor categorise them?

Here is what you need to know about the 5 Key Broker Categories in Europe and the UK. These categories give you a mental model of how to think about brokers, but some of them may not fit in neatly, and availability in your country may also impact your choice.

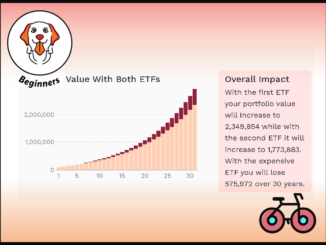

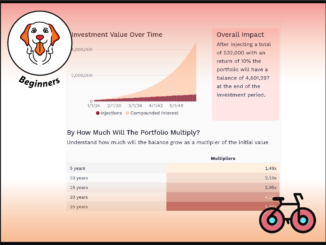

Compare the portfolio impact of two ETFs: an expensive ETF (high TER) and a cheap ETF (low TER)

For most individual investors, Interactive Brokers is simply one of the best platforms. While beginners might find its interface and features complex, the platform is a treasure trove for those willing to scale the learning curve. It is suitable for most passive investors. Very competitive ETF trading commissions and FX rates, no ongoing platform fees along with family subaccounts and monthly standing orders largely justify opening an account.

Understand the impact of compound interest over time and as a multiplier of the invested value. Compare different compounding frequencies.

We live in extraordinary times. Just a decade ago, the mere idea of launching a website like ours, rooted in evidence-based investing, would seem far-fetched due to a general disinterest. Today, academic insights like the recent paper ‘Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice’ by Scott Cederburg, Michael O’Doherty, and Aizhan Anarkulova, which challenges traditional asset allocation are not just noted – they’re often implemented by individual investors.

Navigating the world of bonds can be a treacherous journey, especially when it comes to currency hedging.

Can your strategy change based on your home currency? Does it matter if you invest in Euros, or Swiss Francs? Is the British Pound any different? What about other currencies?

Is the decision to hedge impacted by your life situation and goals?

You may think that spending over a decade on Wall Street would teach me more about successful investing than cycling.

Surpringly, successful investing is more about perspective and wisdom than technicals.

From Tibet to California, here are 8 Investing lessons I learned from Cycling the World.

Interactive Brokers (IBKR) is one of the largest and most sophisticated brokers in the world.

However, understanding how to identify a Stock Exchange may not always be the easiest. Here is how it works.

Between 2019 and 2023, I spent close to a year in Japan. I cycled over 4,000 km from Hokkaido to Okinawa. Here are some tips on how you can make the best of your trip to the country of the rising sun.