If you read about Investing from a US source you know how easy it is to invest in North America

And yet in Europe and the UK, selecting an Equity ETF can be a bit of a different ballgame.

Not only is Europe more fragmented. For instance, the second-largest ETF provider in the US, Vanguard, doesn’t even cover 5% of the market in Europe. There are also oaspects like currencies or dividends.

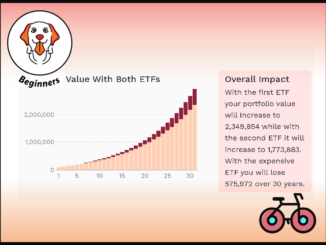

But it’s also never been easier to buy ETFs. By doing some initial research you can avoid life-long fees charged by Robo and Human Advisors.

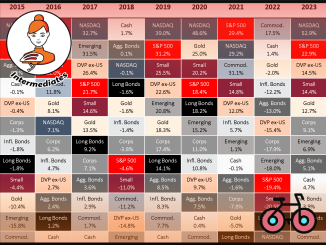

It will make you substantially wealthier.