Crash course to simplify your portfolio – 3 aspects to watch for High Impact Asset Allocation Strategies

KEY TAKEAWAYS

- Larry and RC have collected 77 investing mistakes that investors commonly fall prey to. Each mistake and the evidence behind it is briefly presented in its own chapter, sometimes using personal stories, along with tips on how to avoid it.

- Even though chapters are relatively short, they are informationally very dense. An effective way for readers to digest the material is to focus on one mistake per day to let the material sink in.

- The mistakes can also be used as prompts for interesting finance-related discussions amongst families, friends, or investing groups.

- There are four parts in this book dealing with mistakes that fall into the same broad theme, which we briefly summarize below.

- This book does not put a particular focus on personal finance, but touches upon how to think about the opportunity cost of spending, how to think about withdrawal rates in retirement, and the importance of saving money early to let compounding work its magic.

Here is the full analysis

Key Takeaways

- There are lot of asset classes and thousands individual securities – how do I choose them and but keep my portfolio simple?

- Yes, it’s true that diversification is the only ‘free lunch’ in Finance but too much of a good thing, may be bad. The same applies to diversification

- There are three things you need to watch out for when assessing assets for their diversification benefits : (i) asset correlation (ii) asset behavior in severe market distress and (iii) magnitude of price moves

- Asset Correlation is usually what most people look at when analyzing diversification benefits of asset classes. Correlation benefits and low Bond volatility are the main reason why you need Bonds in addition to Stocks

- Asset behavior in extreme conditions is often overlooked – and that’s when it matters most. This is where you can simplify your portfolio

- But don’t forget why you invest – Magnitude of Price Moves in the long term that correlation doesn’t really capture is sometimes ignored – this is why you may want to keep certain asset classes e.g. Emerging Markets (for fundamental reasons like superior Economic growth) or other Developed Markets for good sectorial mix

- Remember that asset allocation is probably the single most important financial decision you will make – Research shows that the right asset allocation is up to 9x more important than Stock selection and will determine your financial success

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

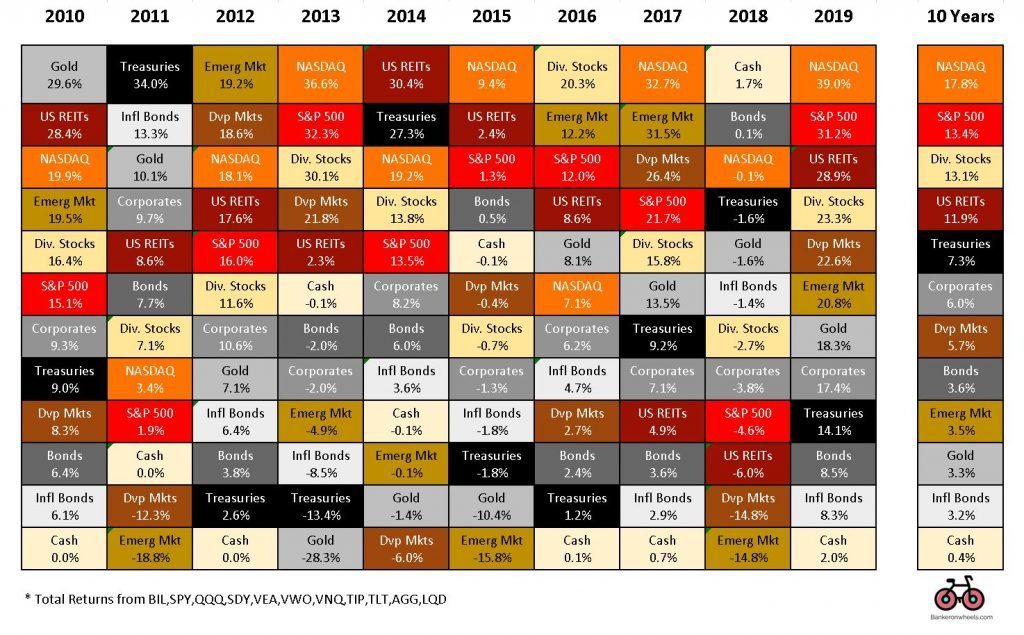

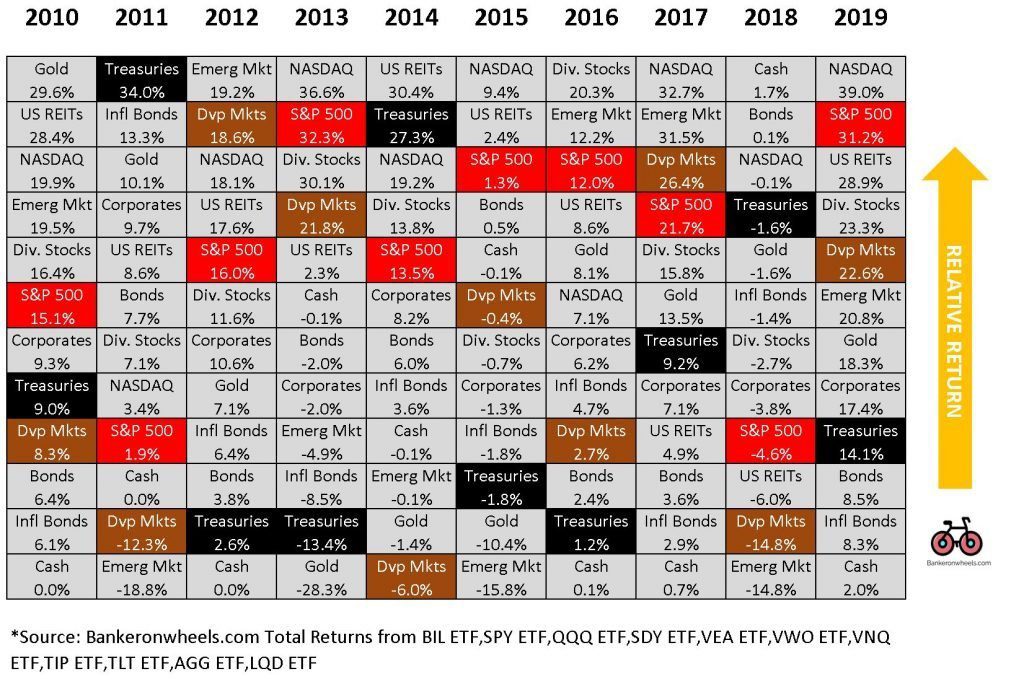

Performance Matrix - Price moves are unpredictable

- In many situations in life, it’s wise to not put all your eggs in one basket. The same holds for investing.

- Understanding how the various asset classes performed is a humbling exercise that shows how unpredictable investments can be and why you need to choose the right mix

- Below are the past 10 years ranked by relative asset class performance

- Last column are average annual returns – what a great decade!

2010 - 2019 Annual Asset Class Returns

Investing is more about following sound principles than knowing the details

Don’t feel intimidated by the number of asset classes – investing can be simple and you don’t need to understand all the technical details. In fact following the right principles will go a long way and can make you a better investor than a lot of professional fund managers

Diversification has three components:

- Asset Correlation – helps you understand if two assets tend to move together

- Behavior in extreme conditions – correlation and magnitude of moves during stress periods (e.g. GFC, Covid-19 Sell-Off)

- Magnitude of long term price moves – even if assets are strongly correlated one can move more than the other (think Emerging Markets vs. Developed Markets based on the long term growth of their economies)

How do assets correlate?

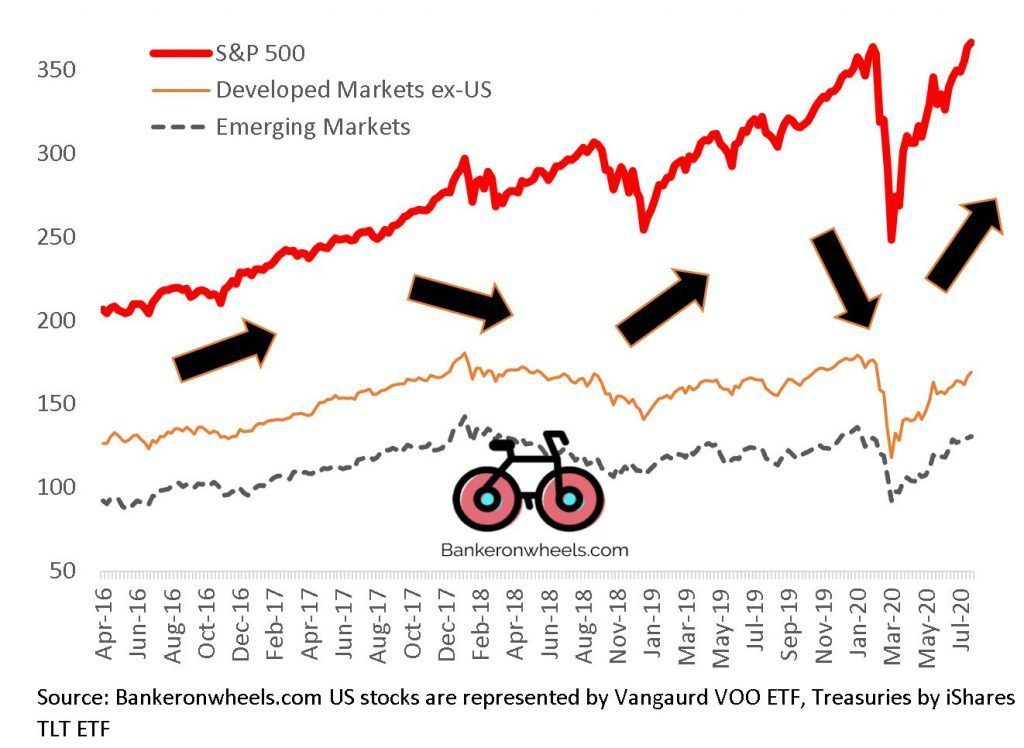

When assets are positively correlated their prices tend to move in the same direction at the same time, think S&P 500 and Developed and Emerging Markets. More generally, Equities are correlated and move together especially during stress periods

Moving together - Global Stocks

A negative correlation is when Assets move in opposite direction during the same period – it is the only ‘free lunch’ in Finance

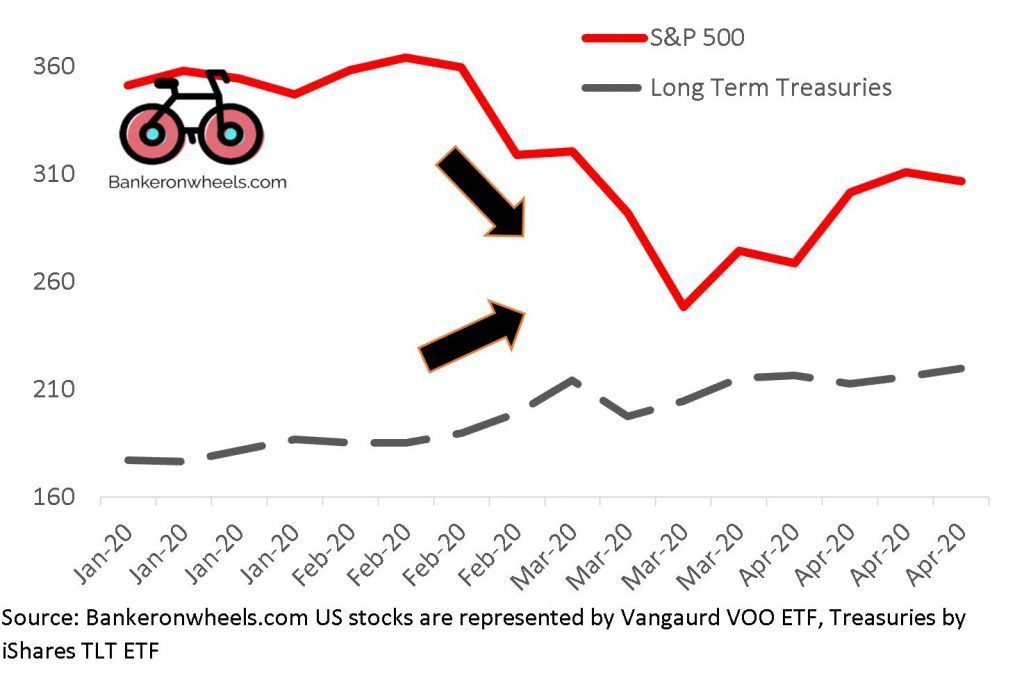

This is generally what happened during COVID-19 March 2020 Sell-off if you look at the monthly price moves (disregard daily technical moves)

Moving opposite - Stocks vs. Treasuries during COVID-19 Market Sell-off

As you would expect this trend extends over long time periods and during the past decade S&P 500 and Treasuries have high returns at very different periods providing a natural portfolio hedge.

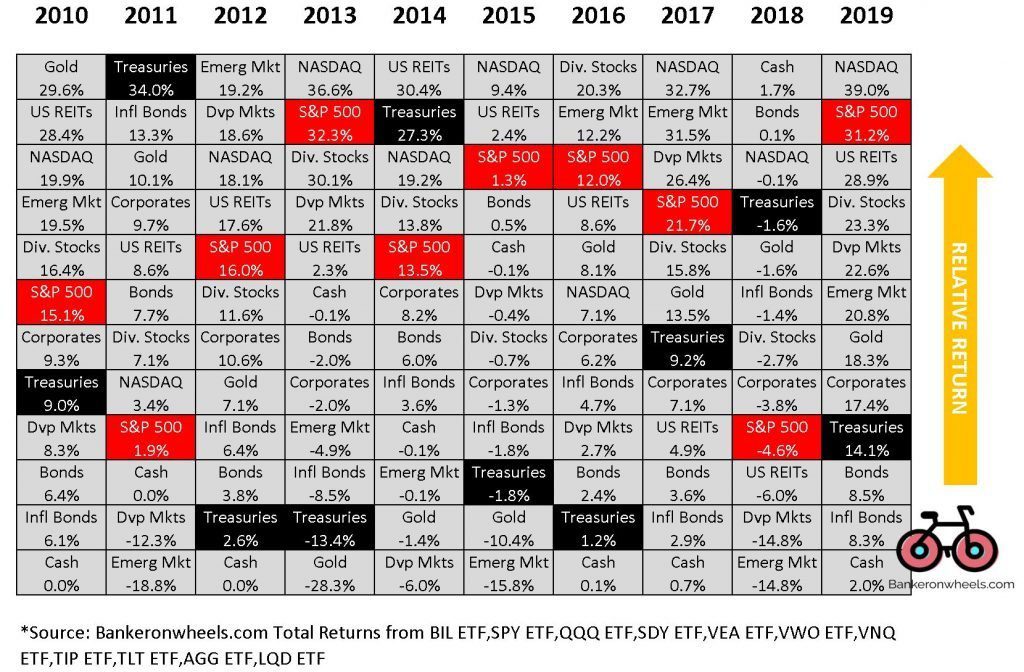

Look at the matrix below focusing only on Long Term Treasuries (that react the strongest to low growth prospects) and S&P 500

Performance Matrix - S&P 500 and Treasuries often rank on opposite sides

Why Long Term Treasuries

Bonds can be more technical compared to Equities – but I have chosen Long Term Treasuries because they react even more than Blend Bond ETFs to any downturn – the idea is to illustrate how Bonds provide downside protection. Ideally, you want Bonds that are in line with your time horizon e.g. if you invest for 10 Years you may want to pick an Intermediate Term Bond ETF. Here is a slightly more technical guide to Bond ETFs and what they currently yield

A first quick way to spot diversification benefits

- To summarize, correlation indicates an increasingly strong relationship between two assets / asset classes up to 1 (or 100%) for a perfectly positive (and -1 or -100% for inverse) relationship

- Two asset classes with perfect correlation would be expected to move up and down together in fixed proportion over a given period of time

- E.g. for the period Jan 2000, through December 2001, the returns of ExxonMobil and Chevron, two very similar oil services firms, correlate at 0.85 on a daily basis. The two companies moved in the same direction on 2,541 days, they moved in opposite directions on 589 days

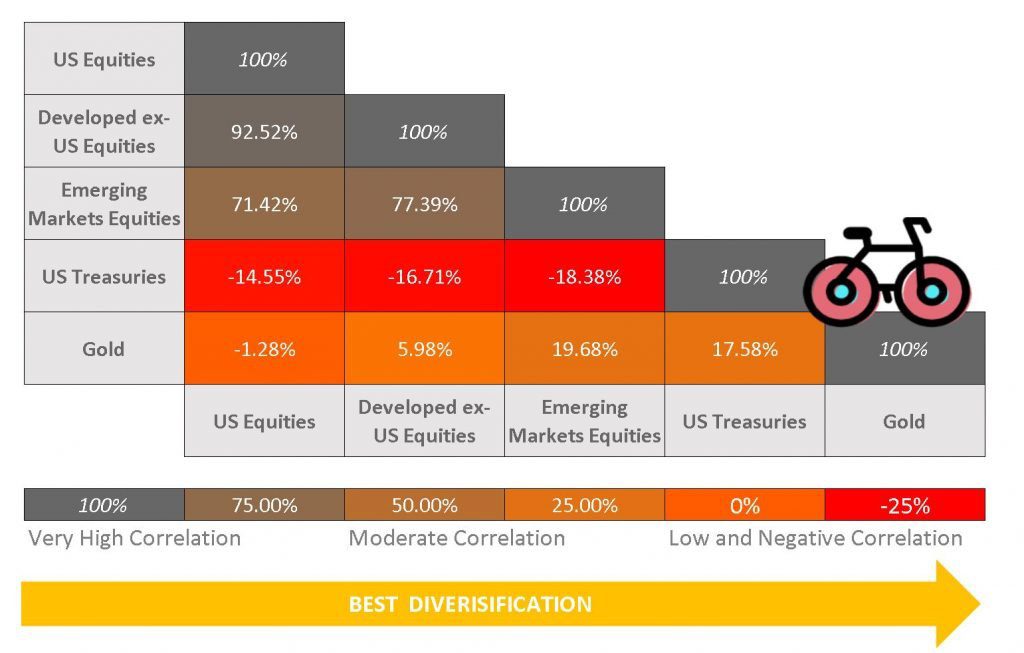

- Below, I have illustrated monthly correlations of some illustrative asset classes e.g. US Treasuries with -14.55% provides best diversification benefit to US Stocks

30 Year Correlations - June 1990 until June 2020 of select Asset Classes

#2 - How do assets correlate during severe sell-offs?

How likely is it that an asset will have a negative month when US Stocks have one of their worst months?

- Correlation relationships (as illustrated by the numbers in the matrix above) are not stable over time

- While Treasuries move -14.55% of time in opposite direction to Equities (‘on average’) this correlation is much lower during Stress Periods

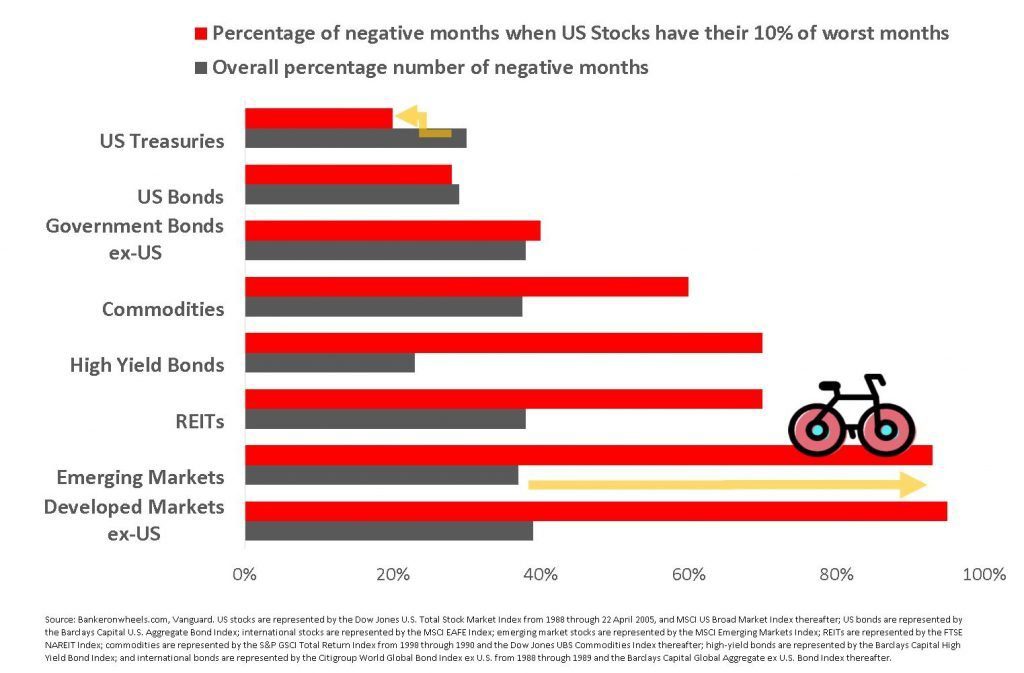

- To illustrate this – look at the below chart

- On average, most asset classes experience negative returns between 20% and 40% of time (measured in months)

- When US Stocks are under severe stress (10% of their worst months) most classes tend also to have a negative month. So, at the exact time when you need diversification most

- This is one of the popular (misguided) arguments against diversification e.g. with Emerging/Developed Markets

- However, both Treasuries and US Bond Funds have a lower number of months with negative returns when US Stocks are under severe stress

Takeaway #1 - Treasuries and Bonds are the best Hedge ...

Proportion of months with negative returns - Overall Average vs Stress Periods from 1988 to 2012

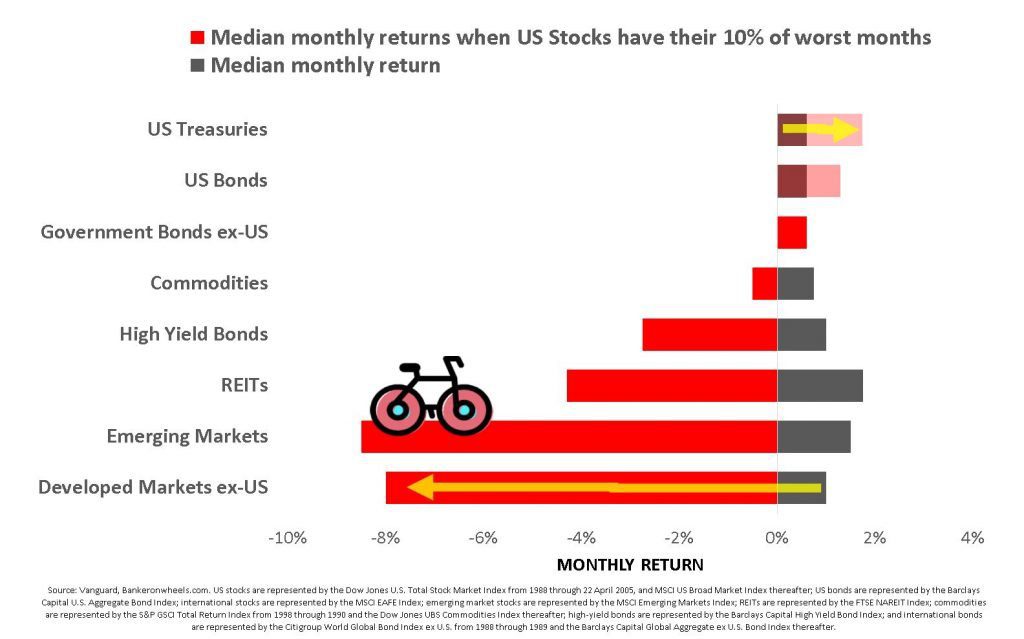

... and generate Extra Cash to buy cheap Stocks

- So, we know that Bonds / Treasuries avoid negative returns more frequently than on average at the exact same time when Stocks are under stress

- The added bonus is that US Treasuries and US Bonds prices will actually increase during the worst sell-offs compared with their long term average

- This may provide you with liquidity to rebalance into cheaper Stocks

Positive Bond Performance - rebalancing will help you buy Stocks when they are cheap

Takeaway #2 - Some assets may not provide enough benefits to justify investing

- This also shows that certain asset classes will experience significant stress when you need diversification

- You should have a strong case why you want to invest in them

Simplify your portfolio & drop asset classes!

The above chart shows that a lot of diversification benefits while useful (see below) can make your portfolio overly complicated without providing a significant advantage e.g. High Yield Bonds, Commodities (Gold while sometimes moving in the same direction as Equities during sell-offs could be an exception) or even REITs if you already have Real Estate Exposure

Treasuries and Bonds seem useful, but why do I need other asset classes since they are (highly) correlated?

As we’ve seen not all asset classes are created equal and some provide you with very significant edge during market sell-offs

- Research proves that over the long term correlation is only part of what you need to focus on.

- Over longer horizons, underlying economic growth matters more than short-lived panics with respect to returns, and international diversification does an excellent job of protecting investors. I have described why International Equities need to be included in a Long Term Portfolio.

- In a nutshell, while correlation may be high especially during sell-offs the upside potential (magnitude of price moves) over the long term will be different (think Emerging Countries growth). You probably don’t want to miss on this potential.

Correlation shows if you're moving in the same direction, magnitude by how much you move

The above matrix shows the concept of price move magnitude:

- Developed Markets, Emerging Markets and US Stocks tend to move in the same direction (vs Bonds/Treasuries)

- We saw a confirmation of this from the above correlation matrix for all type of Stocks

- US, Developed Countries ex-US and Emerging Countries correlations were all above 70% (!) but the magnitude of price moves can be very different

Performance Matrix - Developed Markets (outside US) and US move together, but magnitude is different

When US Equities and Bonds may not be enough

It largely boils down to investment horizon. In a Short/Medium Term Portfolio US Equities (for US Investors) can be enough – but in a Long Term portfolio this is a risky strategy

I have written why the popular arguments for US centric portfolio are not accurate from academic research point of view but most importantly you should review the takeaways from the biggest market crashes to understand why international diversification is key from a risk perspective not only for smaller countries

How do I select Emerging Market and Developed Market ETFs?

International ETFs can be confusing due to different naming conventions of the Index Providers – I had a deep dive into the way they work, and hope you can benefit from it as well.

Understand how ETFs track benchmarks to control (i) Countries, (ii) Developed vs Emerging economies and (iii) Size of companies (large to micro caps) and choose the Best International ETFs for your Equity Portfolio.

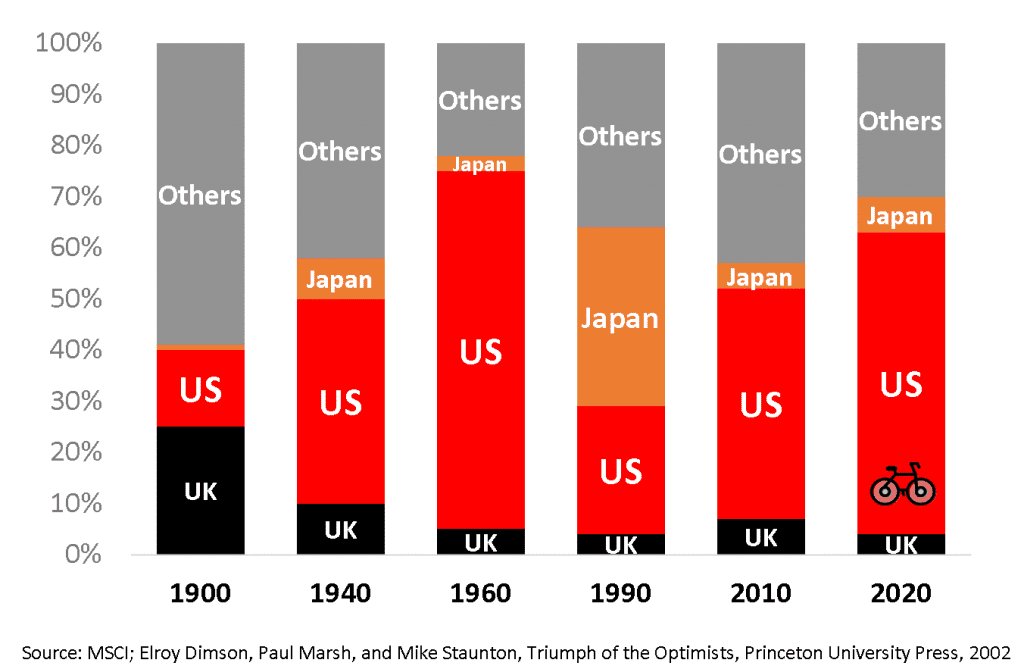

Are you willing to restrict yourself to one market? Relative Equity Markets Performance by size (1900 to 2020)

#4 - What about Currencies?

- If you live in Europe or UK investing in a globally diversified portfolio means you are getting significant exposure to foreign currency, typically USD since roughly half of World Equities are in the US

- Similarly, US Investors face ETF Currency Risk with International Equities

- Currencies can fundamentally change the risk/return profile of your portfolio if you don’t hedge it correctly – understand the best practices for your long term investments

How to build a Long Term Portfolio?

I have created a model portfolio for Long Term Investors. While this takes a view of a US Investor the same asset allocation applies for European or UK Investors

Understand what proportion of Bonds you need and how to combine key asset classes

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

Conclusion

- When selecting assets for your portfolio look at long term risk and return profiles as guidance

- Use diversification, as it’s is the only free lunch in finance

- Diversification is composed of (i) correlation, (ii) tail risk behavior and (iii) magnitude of moves

- Use Correlations as a starting point to simplify your portfolio – It’s key to start with a correlation matrix to keep only the key asset classes you need

- But remember that correlation is only one part of diversification. High correlations may discourage you from investing in certain asset classes – Emerging and Developed Country Stocks are highly correlated and over the short term, global diversification can disappoint but look beyond short term

- Most importantly, think why you invest while short-term crashes can be painful, long-term returns are far more important to wealth creation and destruction

Good luck!

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

4 Things I Learned In 4 Years Of Running A Finance Blog

Weekend Reading – JP Morgan Guide To Retirement

Surviving The Next Bear – Strategies To Profit From The Next Market Crash

Weekend Reading – Asset Class Returns since 1970 & Trend Following Strategies

Cracking the Code: Decoding ETF Names & Discovering Tools To Find Them

Broker Review Methodology

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.