Asset Allocation Investment Ideas if you think most of the Fund Managers got it wrong

Asset Allocation: some interesting findings came from Bank of America that published the May 2020 Fund Manager Survey where they interviewed close to 200 Investors about current allocations and views. Some of the readings are quite extreme in the historical context.

This is also another reason to stick with the Passive Index Funds approach (that you may want to protect in case of shorter investment horizon)

Summary of Findings

Here are some Contrarian trade ideas from Bank of America based on their Survey – note that these are pretty aggressive/risky based on current environment:

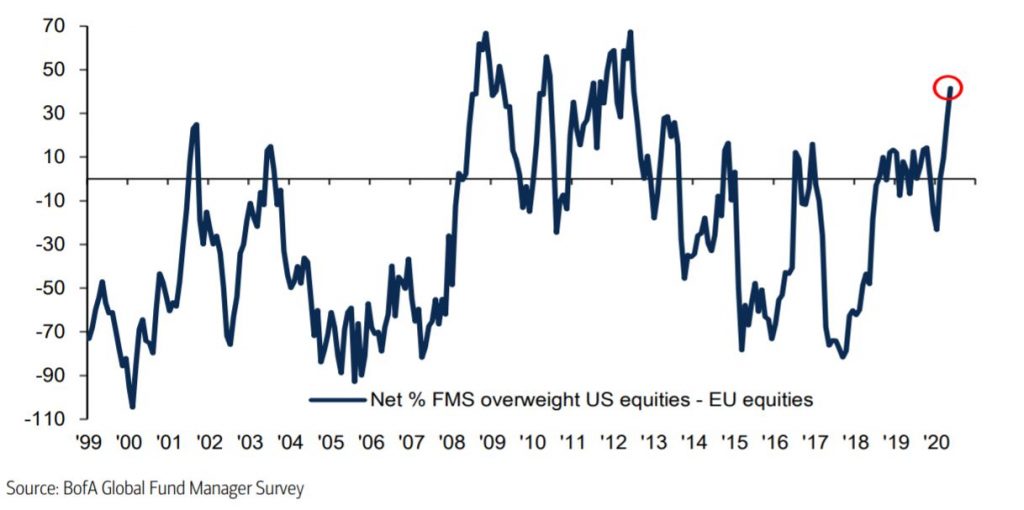

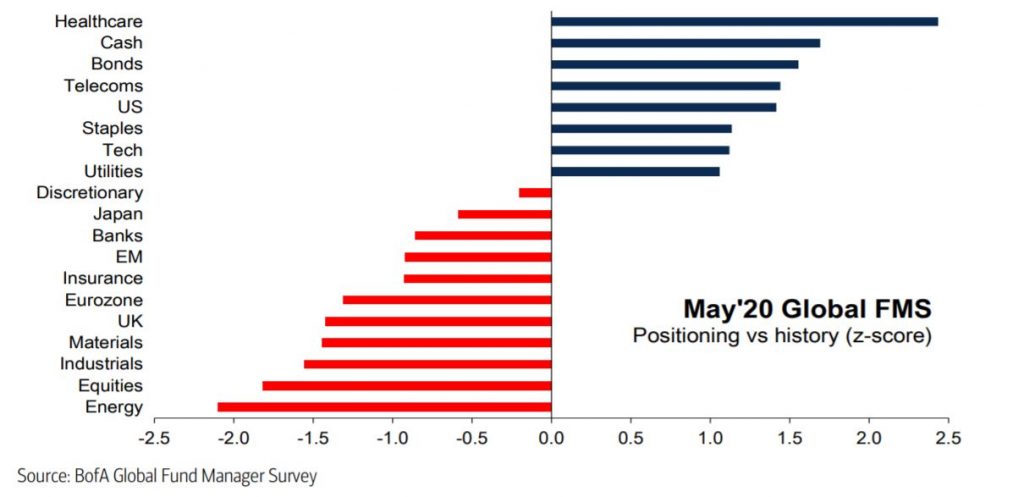

- Sectors: Investors looking to play upside: short US tech, long

energy-short healthcare - Geography: long Europe-short US; Fund managers are long U.S. equities and short euro-zone stocks, the poll shows.

- Value vs. Growth Stocks: Investors looking to play structural

reshoring theme…long value-short growth, long small cap-short large cap.

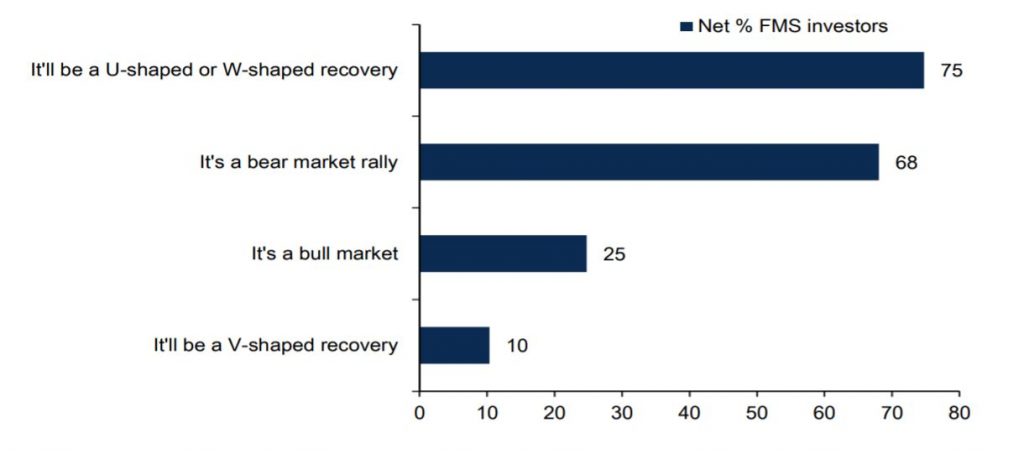

68% of Managers believe this is a bear market rally

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

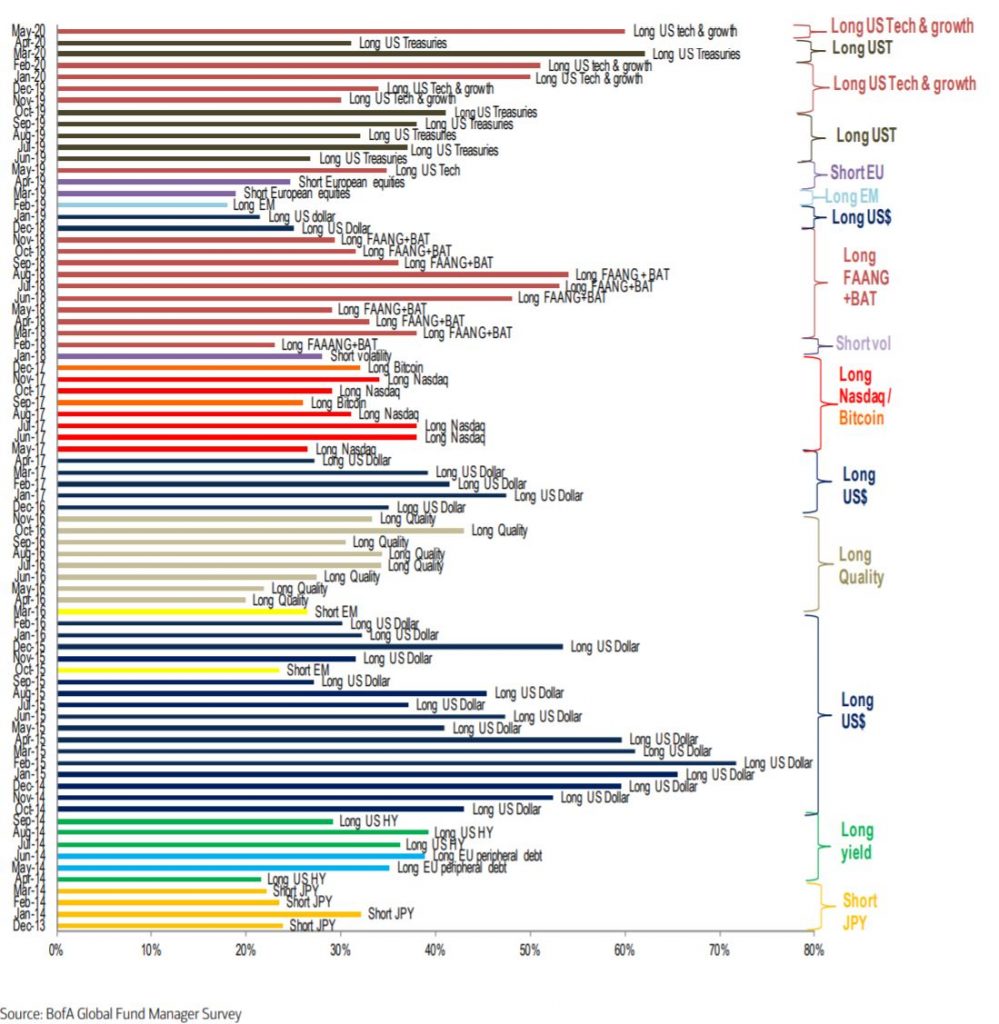

The most crowded trades are US Tech, Growth and US Treasuries

Bank of America notes:

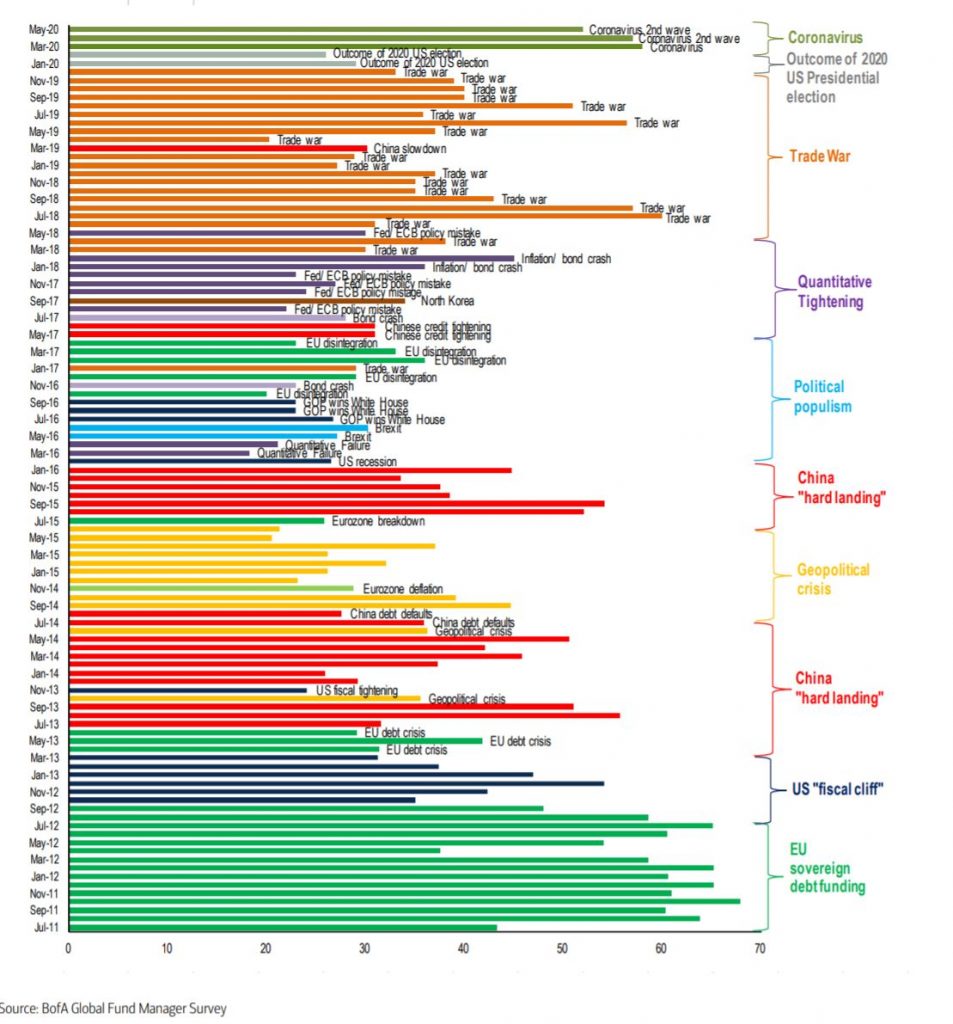

• The dominant concerns of investors since 2011 have been Eurozone debt &

potential breakdown; Chinese growth; populism, quantitative tightening & trade

wars; now global coronavirus.

• Now, Coronavirus 2nd wave dominates with 52% of FMS investors saying it is the top “tail

risk”; #2 Permanently high unemployment, #3 Break-up of the European Union, #4

Systemic credit event.

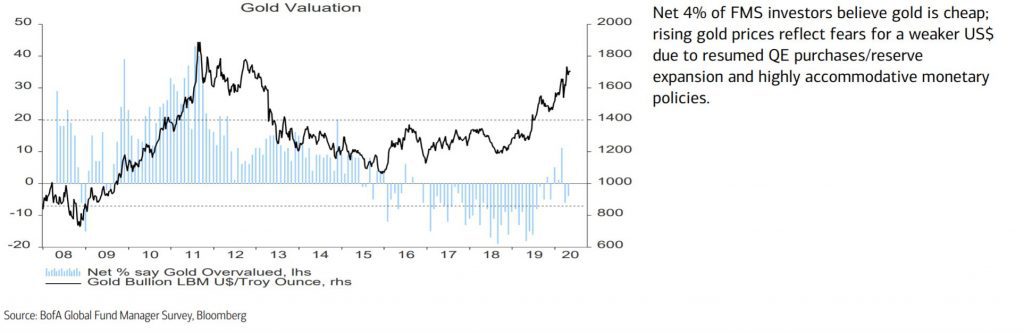

Net 4% of Investors believe Gold is Cheap

Read our take on the relative value of Gold in this market

US Equities are preferred to European ones to the highest degree since the European Sovereign Crisis in 2011

Investors are Underweight Energy, Industrials and Materials - Value Stocks are net sold at this stage

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

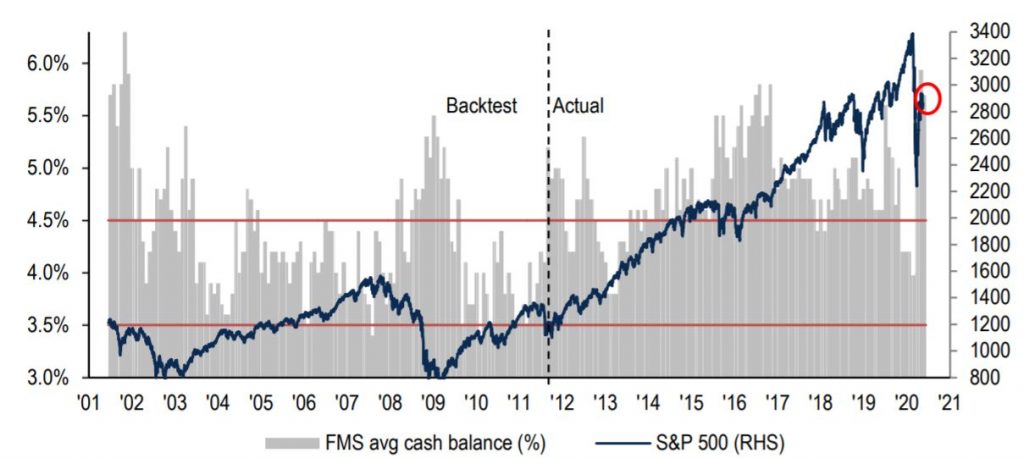

Cash is at highest levels in portfolios since 2016

Bloomberg also noted that the latest BofA survey showed a marginal reduction in cash levels to 5.7%, which is still well above the 10-year average of 4.7%, while bond allocation jumped to the highest since the 2009 financial crisis. Exposure to equities in May rose 10 percentage points to a net 16% underweight after hitting the lowest level since 2009 last month, according to BofA.