How safe are Bond ETFs?

Are Bond ETFs Safe? Bonds are supposed to provide safety, especially in times of crisis. They are safe up to an extreme point at which point FED had to step in

Here is what you need to know about what happened during the Coronavirus Market Crash to Bond ETFs:

- Bond ETFs have been severely stress tested during the March market crash and appeared much more liquid than the underlying – providing some comfort to investors willing to trade immediately

- We will probably never have to know with certainty whether some of these funds can withstand extreme stress, though. The FED as buyer of last resort provided the ultimate safety net (below I also review which funds the FED is currently buying)

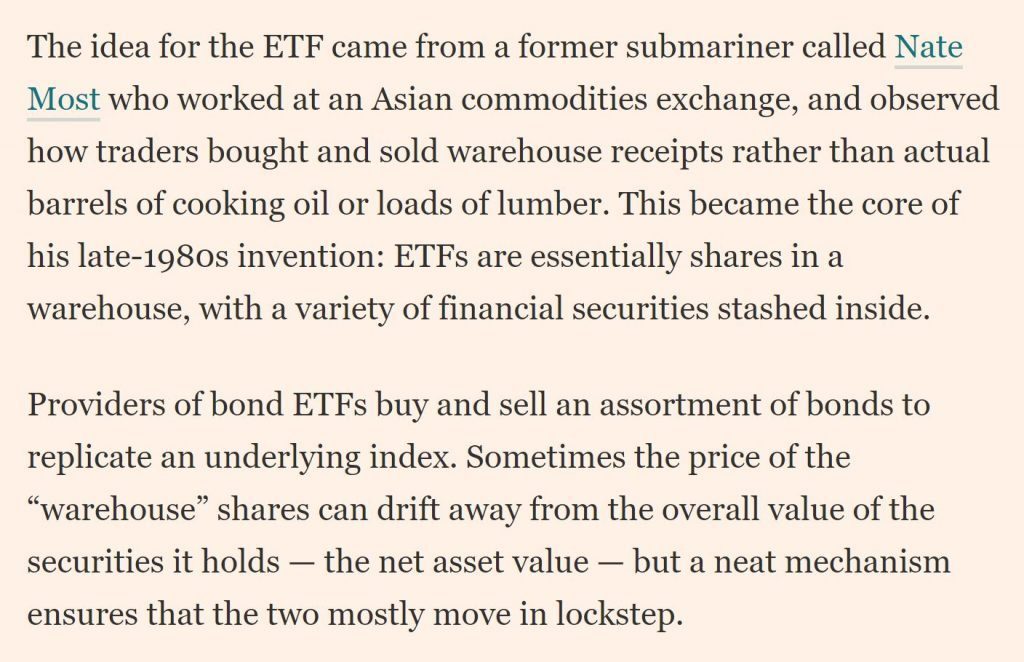

How do ETFs work?

What got certain Investors worried?

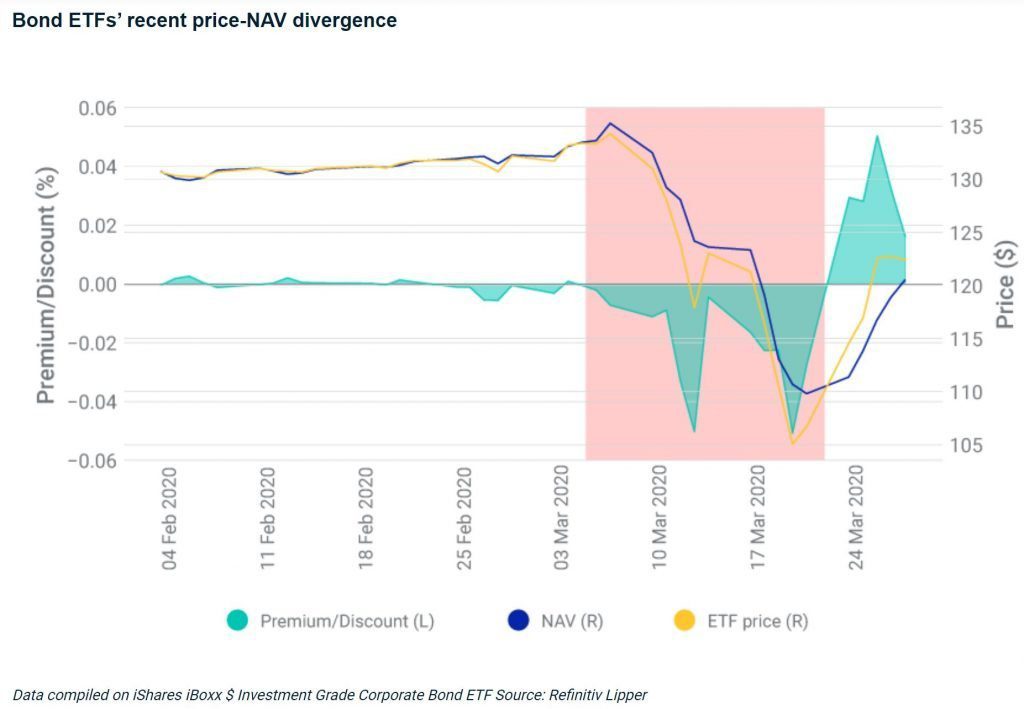

- ETFs have two measures of ‘value’ (i) Net Asset Values reported by the Index Fund provider and (ii) Prices that you observe on the Exchange

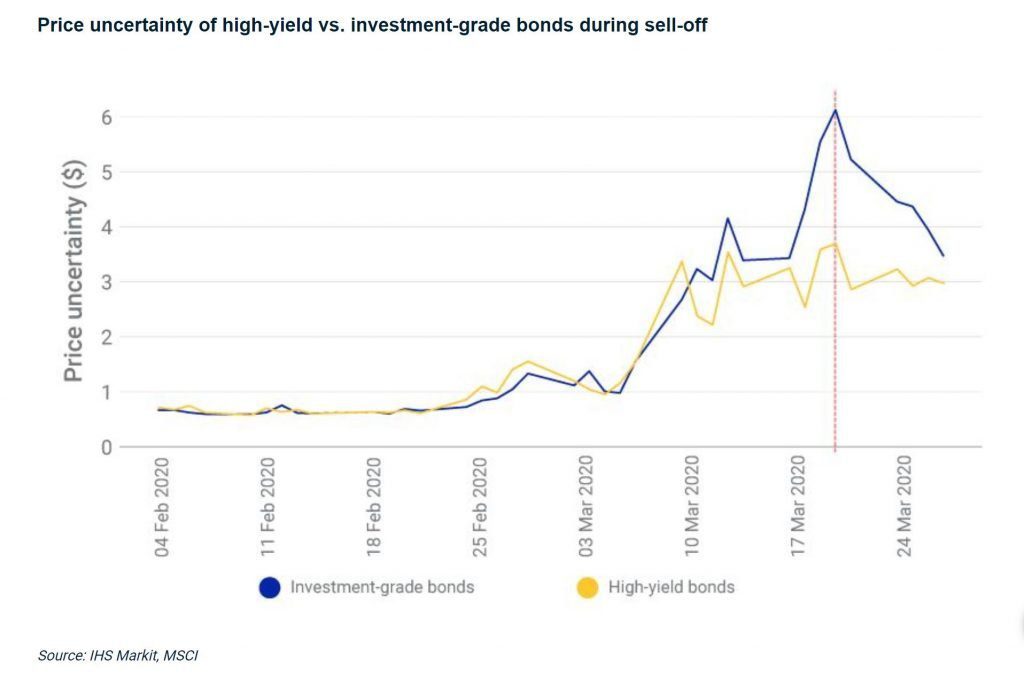

- During the Market Crash these two values have diverged by as much as 5-6% for certain Bond ETFs

- The nature of this comes down to the characteristic of Bonds. Of the 21,175 publicly registered company bonds in the US in 2018 only 246 traded daily which means Bonds are much less liquid than Stocks that trade continuously

- During big market stress certain Investors need to meet immediate redemptions and dump Bond ETFs because they trade like Stocks whereas the underlying Bonds don’t

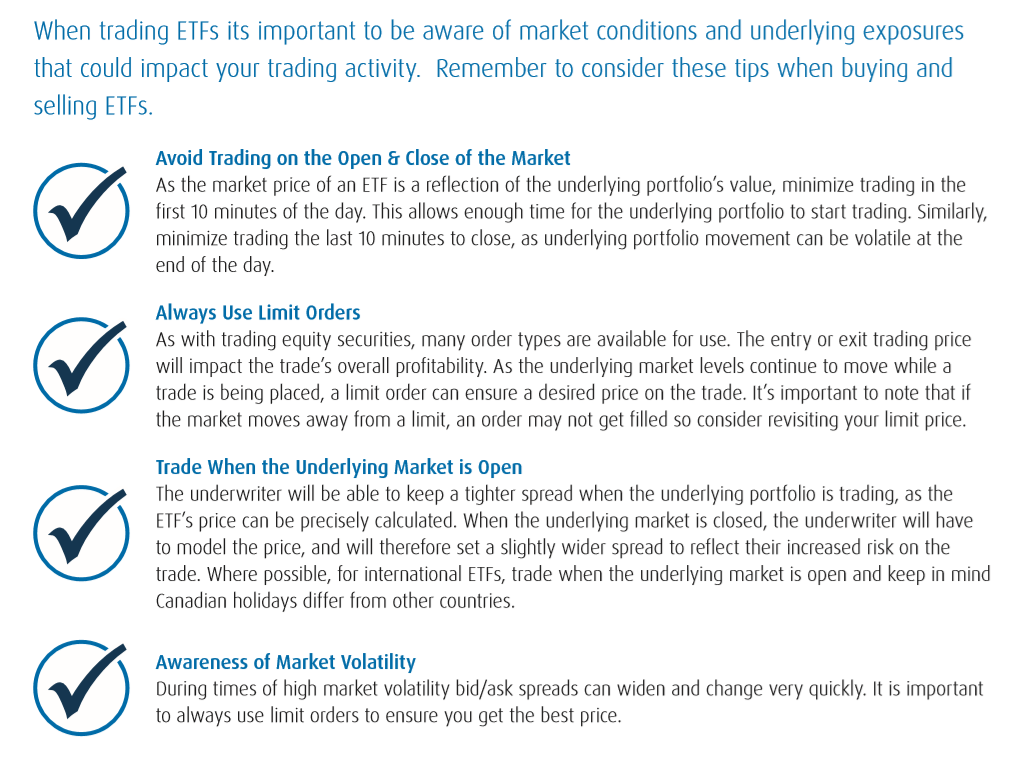

- Ideally you want to limit trading ETFs on those days to avoid big intraday swings but it is good practice to place limit orders if needed

❤️🐶 Shop & Support - Celebrate our 4th anniversary! 4️⃣🎂

Spread the Golden Retriever Wisdom Across Europe & the UK 😎

Banker On Wheels is 4 years old! To celebrate our anniversary we have launched the official merchandise store – Shop.Bankeronwheels.com. You can now get your favourite Golden Retriever, or your factor tilt on a coffee mug or a T-Shirt while supporting our cause! All profits are reinvested into creating more educational content. Alternatively, you can also buy us a coffee. Thank you for all your support ❤️

Bond ETFs are much more liquid than Bonds

You may be used to how Stocks trade. There are fundamental differences with Bonds:

- Bonds are much less liquid. According to Citibank of the 21,175 publicly registered company bonds in the US in 2018 only 246 traded daily which means Bonds are less liquid than Stocks that trade continuously

- However, Bond ETFs are liquid and do trade like stocks on a continuous basis and may be based on price assumptions of the underlying Bonds that are more accurate than the underlying that don’t trade

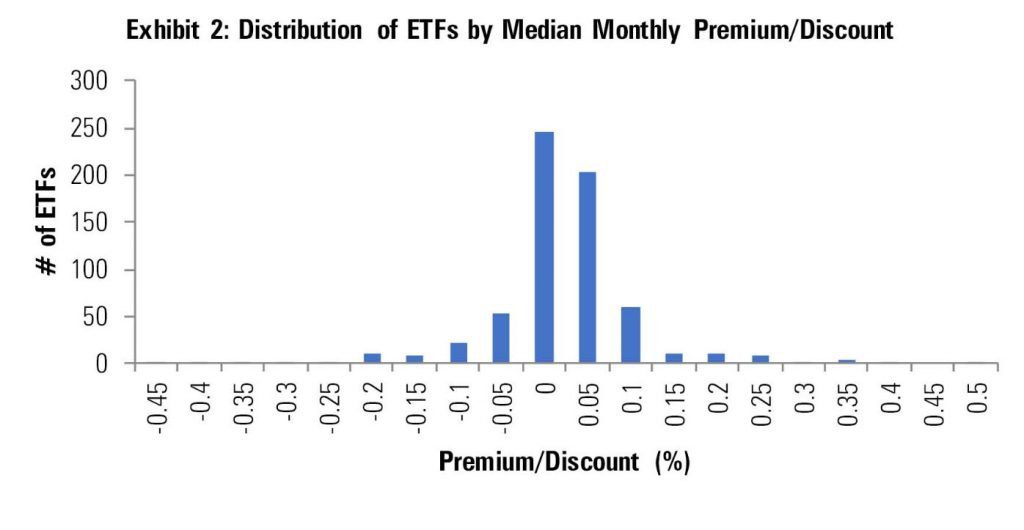

- To avoid this issue ETF providers use indications of Bond prices (bids) instead of actually transacted prices for calculation of the NAV. The daily closing price of ETF is calculated using the mid points between bid and ask price (difference between what someone is willing to pay to buy and ready to sell at). But these discrepancies are historically minor as per the chart below:

- Bonds don’t trade directly via exchanges like Stocks but through Dealers that may stop providing bids (prices that they are ready to buy for). It’s a one way market and most investors at that moment are sellers.

- During Market Stress Periods certain Investors (e.g. those who have both Bond ETFs and Bonds) need to meet immediate redemptions and dump Bond ETFs because they trade like Stocks (much more liquid) whereas the underlying Bonds would be illiquid temporarily creating discrepancies

ETF traded lower than the Net Asset Values of the Fund (NAV)

Bond ETFs prices are more 'updated' than NAVs (which may be stale) especially in volatile markets

There are intermediaries involved that make money out of differences between the prices of the underlying bonds and the ETF price. This mechanism works best when uncertainty of the prices of the underlying bonds (defined by MSCI as the difference between highest and lowest price during the day) is low

ETF prices converge to Bond prices once the panic stops. Bonds will provide you with security over the long term and diversify your Stock portfolio. Trading them in the middle of a market rout is probably not the best idea, but if you need to the best market practice is to put limit orders and not market orders to better control execution as explained here

From Bankeronwheels.com

Get Wise The Most Relevant Independent Weekly Insights For Individual Investors In Europe & the UK

Liked the quality of our guides? There is more. Every week we release new guides, tools and compile the best insights from all corners of the web related to investing, early retirement & lifestyle along with exclusive articles, and way more. Probably the best newsletter for Individual Investors in Europe and the UK. Try it. Feel free to unsubscribe at any time.

🎁 In the first email, you can download a FREE comprehensive 2-page checklist to construct & monitor your portfolio and clean up your personal finances.

How to invest in Fixed Income ETFs

Why to invest in Bond ETFs? High Quality Bond ETFs remain safe

- Bond ETF will provide your portfolio with necessary diversification in a downturn

- Certain Bond ETFs are safer than others and will be better for diversification e.g. Treasuries or Aggregate Bond Funds – see our Fixed Income Index Fund guide

- ETFs will absorb shocks up to a certain point providing liquidity (because of its elastic mechanism and the fact that ETFs are also available to Retail investors while Bonds usually aren’t) whereas the underlying Bonds is illiquid

- However, should the market be tested to its inflection point the ultimate safety net remains the FED that would need to step in to contain extreme panic (arguably, as with most asset classes)

- Certain categories of Bonds and Index Funds are by nature more speculative and carry more risk e.g. High Yield Funds (even if the FED has some stake) and you should avoid if your goal is to add safety to your portfolio (categories explained here)

- You should use Limit Orders if you really want to trade Bond ETFs in a volatile market to ensure best execution

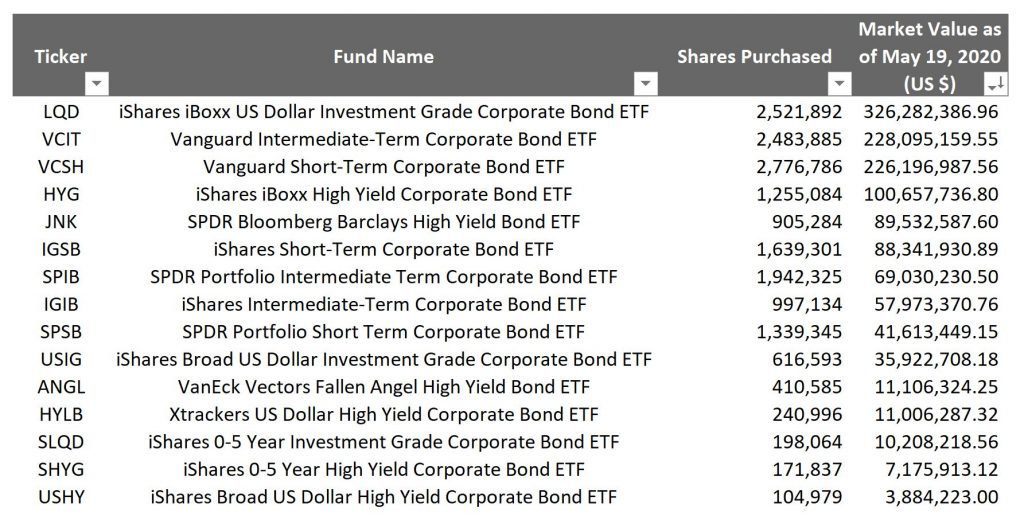

Which Bond Funds is the FED buying now?

It’s always safe to know that the FED is buying the ETF you’re invested in, here are the trends based on the top holdings:

- The FED predominantly buys from the largest Asset Managers (BlackRock iShares, State Street SPDR and Vanguard)

- The FED buys mainly Short term and Intermediate Term ETFs

- High Yield Funds are well diversified with small stakes including iShares iBoxx High Yield Corporate Bond ETF and SPDR Bloomberg Barclays High Yield Bond ETF but the vast majority in concentrated in high quality Investment Grade Corporate Bonds

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

Broker Safety: Should You Rely On Broker Insurance?

Dodl By AJ Bell Review – AJ Bell’s Younger Brother

Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Why Do Portfolio Managers Care About Factors? It’s Not What You Think.

Money Market Funds: Are ETFs The Best Bang For Your Buck Or A Risky Ride?

4 Things I Learned In 4 Years Of Running A Finance Blog

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🐶 Purchasing Our Official Merchandise

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.