Menu

Bankeronwheels.com is unlike most Investment websites you have come across

Bankeronwheels.com is unlike most Investment websites you have come across

BlackRock Launches New iBonds & Truth About Broker Insurance. BoW is 4 Years Old!

Investment Projection Schemes In The EU Are Inadequate. Could An Independent Insurance Be A

SHOULD YOU START A FINANCIAL BLOG IN 2024? When I launched Bankeronwheels.com four years ago, my ambition was to spread knowledge to a diverse audience

While the older brother AJBell strides with clear direction, Dodl seems a bit lost,

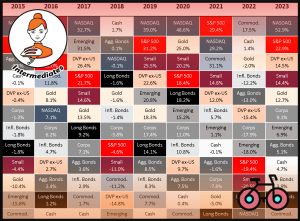

Your friend’s stock first skyrocketed, then hit a plateau, and ultimately lagged behind the

Banker on Wheels’ Easy Ride to Factor Investing – Part 1 Welcome to Part 1 of Bankeronhweels.com Guide to Factor Investing. My first job on Wall

Banker on Wheels’ Easy Ride to Factor Investing – Part 1 Welcome to Part 1 of Bankeronhweels.com Guide to Factor Investing. My first job on Wall

The Stock Market is a powerful money-making machine that can make you rich and

Bankers are a rational bunch unless you talk to

2022 reminded us that trees don’t grow to the

Expats face unique challenges – financial regulations of both

Your friend’s stock first skyrocketed, then hit a plateau,

Some ETFs track the same benchmarks as well-known Money

If you read about Investing from a US source

ETF Domicile is not very glamour. And something that

Navigating the world of bonds can be a treacherous

Investment Projection Schemes In The EU Are Inadequate. Could

While the older brother AJBell strides with clear direction,

When choosing a broker, investors face a myriad of

iWeb Share Dealing is the typical boring, but cost-efficient

AJBell is a Tier 1 broker with a good

Get FREE access to our best investing resources. Likely the single best newsletter for individual investors in Europe.

Unsubscribe at any time.

Don’t spend your entire life working a job you don’t love so that you can maybe retire at 65. Make your money work for you while you sleep.

Most of what’s published and shared about money is either wrong or so old school that it’s obsolete.

Given a reasonable time horizon and if you follow the right principles, you have, by historical standards, no chance of losing money. Join our newsletter today to improve your odds of reaching financial freedom sooner.

Don’t spend your entire life working a job you don’t love so that you can maybe retire at 65.

Make your money work for you while you sleep.

Given a reasonable time horizon and if you follow right principles you have, by historical standards, no chance of losing money.

Join our newsletter.

Get free access to our best investing resources. Likely the single best newsletter for individual investors in Europe.

Unsubscribe at any time.

Copyright © 2020-2024 Bankeronwheels.com. All rights reserved.

Sitemap |Privacy Policy | Terms and Conditions | Coaching Terms and Conditions | Contact | About | Transparency| Cookies